Table of Contents

Wondering if your State Farm policy covers rental trucks? Read this article to find out what is and isn’t covered.

Are you planning on renting a moving truck for your next big move? If so, you may be wondering if your State Farm policy will cover any damages or accidents that may occur during your rental. Well, the answer is not as straightforward as you may think. While State Farm does offer some coverage for rental trucks, there are certain limitations and exclusions that you should be aware of before hitting the road. So, before you sign on the dotted line and hand over your credit card information, let’s take a closer look at what your State Farm policy may or may not cover when it comes to rental trucks.

Does My State Farm Policy Cover Rental Trucks?

If you’re planning to move soon and have found yourself in need of a rental truck, you may be wondering if your State Farm policy covers rental trucks. After all, no one wants to get into an accident or experience some other mishap while driving a rental truck, only to find out that their insurance won’t cover the damages.

Types of Rental Trucks

Before we dive into whether or not your State Farm policy covers rental trucks, it’s important to understand the different types of rental trucks that are available. Most rental truck companies offer several different sizes of trucks, ranging from small cargo vans to large moving trucks capable of hauling an entire household’s worth of belongings.

Collision and Comprehensive Coverage

When it comes to rental trucks, the coverage that you’ll need will depend on the type of damage that occurs. Collision coverage will kick in if you’re involved in an accident with another vehicle or object, while comprehensive coverage will cover non-collision events such as theft, fire, or vandalism.

Liability Coverage

In addition to collision and comprehensive coverage, liability coverage is also important when it comes to rental trucks. Liability coverage will protect you if you’re at fault for an accident and someone else is injured or their property is damaged. It’s important to note that liability coverage does not cover any damage to the rental truck itself.

State Farm’s Rental Vehicle Coverage

So, does State Farm policy cover rental trucks? The answer is yes, but it depends on your specific policy. If you have comprehensive and collision coverage on your personal vehicle, then those coverages will extend to a rental truck that you’re driving. However, if you only have liability coverage, then you won’t be covered.

It’s also important to note that State Farm offers a specific type of coverage called rental vehicle coverage. This coverage can be added to your policy and will provide additional protection when you’re renting a vehicle. Rental vehicle coverage includes liability, collision, and comprehensive coverage, as well as coverage for loss of use and towing expenses.

Rental Truck Insurance from the Rental Company

Another option when it comes to insuring a rental truck is to purchase insurance directly from the rental company. Most rental companies offer some form of insurance coverage, which can range from basic liability coverage to more comprehensive coverage that includes collision and theft protection.

While purchasing insurance from the rental company can provide additional peace of mind, it’s important to note that this coverage can be expensive. In some cases, it may be more cost-effective to rely on your personal auto policy or to purchase rental vehicle coverage from State Farm.

What to Do in the Event of an Accident

If you’re involved in an accident while driving a rental truck, the first thing you should do is make sure that everyone involved is safe and call the police if necessary. You should then contact your insurance company and let them know what happened.

If you purchased insurance from the rental company, you’ll also need to contact them and follow their specific procedures for reporting an accident. It’s important to document as much information as possible about the accident, including taking photos and getting the contact information of any witnesses.

Final Thoughts

So, does State Farm policy cover rental trucks? The answer is yes, but it depends on your specific policy and the coverage that you have. If you’re planning to rent a truck for an upcoming move, it’s important to review your insurance policy and consider adding rental vehicle coverage if necessary.

Additionally, it’s important to take steps to drive safely and avoid accidents while driving a rental truck. Remember to stay focused, take your time, and always follow the rules of the road.

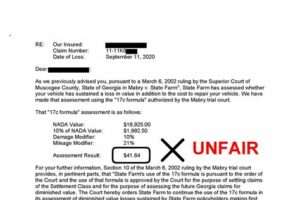

When it comes to renting a truck, it’s important to understand your insurance coverage. The gray area of rental truck coverage is a common concern for many State Farm policyholders. So, is rental truck coverage a standard part of State Farm insurance? The answer is not necessarily. While liability coverage may extend to a rental truck, it may not be enough to fully protect you in the event of an accident.

It’s important to understand State Farm’s automobile insurance policy limitations when it comes to rental trucks. Depending on your policy, there may be restrictions or exclusions that apply to rental vehicles. For example, some policies may only cover rentals within the United States and Canada, while others may have limits on the duration of the rental.

While liability coverage may be enough for some rental truck needs, it’s important to consider if additional coverage is necessary. This could include collision coverage, which would help pay for damages to the rental truck in the event of an accident, or comprehensive coverage, which would cover non-collision events such as theft or damage from weather-related incidents.

When renting a truck, it’s important to watch for potential coverage gaps. For example, the rental company may offer insurance coverage, but it may not be enough to fully protect you. Additionally, if you’re using the rental truck for business purposes, your personal auto insurance policy may not provide coverage.

Comparing rental truck coverage across various insurance providers can also be helpful. Some companies may offer more comprehensive coverage options, while others may have more restrictions or exclusions. It’s important to review your options and choose the coverage that best fits your needs and budget.

In the event of an accident with a rental truck, the process can be complicated. You’ll need to contact both your insurance provider and the rental company, and there may be different rules and procedures to follow. It’s important to review your insurance policy and understand what steps you need to take in the event of an accident.

The importance of reading the fine print in your insurance policy cannot be overstated. This will help you fully understand your coverage and any limitations or exclusions that may apply. If you have questions or concerns, it’s always best to reach out to your insurance provider for clarification.

As a State Farm policyholder, navigating rental truck insurance can be confusing. However, there are tips to help make the process easier. This includes reviewing your policy regularly, considering additional coverage options, and asking your insurance provider for guidance when needed.

In conclusion, while rental truck coverage may not be a standard part of State Farm insurance, it’s important to fully understand your coverage options when renting a truck. By doing so, you can ensure that you’re fully protected in the event of an accident or other incident.

Have you ever found yourself in the middle of a move and realized you need to rent a truck to transport all your belongings? The thought of rental truck insurance can be daunting, but if you have a State Farm policy, you may already have coverage.

Here are some things to consider:

- Check Your Policy: The best way to determine if your State Farm policy covers rental trucks is to review your policy documents or contact your agent. Some policies may include coverage for rental vehicles, while others may require an additional endorsement.

- Types of Coverage: If your policy does cover rental trucks, it may include liability and collision coverage. Liability coverage would protect you if you were at fault in an accident and caused damage to another person’s property or injury to someone else. Collision coverage would cover damage to the rental truck itself.

- Rental Truck Insurance: Even if your State Farm policy covers rental trucks, you may still want to consider purchasing additional insurance from the rental company. This can provide additional protection and peace of mind, especially if you’re transporting valuable items.

- Driving Record: Before renting a truck, it’s important to remember that your driving record will impact your insurance rates. If you have a history of accidents or traffic violations, your rates may be higher.

- Safe Driving: It’s always important to practice safe driving habits, but even more so when you’re behind the wheel of a large rental truck. Be sure to follow all traffic laws, avoid distractions, and take extra precautions when turning or backing up.

In conclusion, if you’re planning a move and need to rent a truck, it’s worth checking with State Farm to see if your policy includes coverage. Remember to also consider purchasing additional insurance from the rental company and practicing safe driving habits. Happy moving!

Hello there, dear blog visitors! I hope you are enjoying our discussion about State Farm policies and rental trucks. As we wrap up our conversation, let me give you a quick summary of what we’ve learned so far.

Firstly, we’ve established that State Farm policies can provide coverage for rental trucks, but it depends on the type of policy you have and the circumstances surrounding your rental. Secondly, we’ve talked about the importance of checking with your insurance agent to confirm your coverage and avoid any surprises or gaps in protection. Lastly, we’ve highlighted some tips for renting a truck and minimizing risks while on the road.

Now, let me leave you with some parting thoughts. As you navigate the world of rental trucks and insurance coverage, remember to prioritize safety and responsibility. Driving a large vehicle requires extra caution and attention, so take your time and follow the rules of the road. Additionally, always be honest and transparent with your insurance provider. If you’re not sure about something, ask questions and seek clarification.

Thank you for joining us today and exploring this important topic. We hope you found our insights helpful and informative. Remember, when it comes to rental trucks and insurance, knowledge is power. Stay safe and happy driving!

.

When it comes to renting a truck, many people wonder if their State Farm policy will cover the rental. Here are some of the most common questions people ask:

- Does State Farm offer rental truck coverage?

- Does my State Farm policy cover rental trucks?

- Do I need to purchase additional insurance when renting a truck?

- What if I’m using the rental truck for business purposes?

- What if I get into an accident while driving a rental truck?

Yes, State Farm offers rental truck coverage as part of their auto insurance policies. However, coverage may vary depending on your specific policy and location.

If you have comprehensive and collision coverage on your policy, it may extend to rental trucks. However, it’s important to check with your agent to confirm what is covered under your specific policy.

It depends on your State Farm policy and the rental company’s requirements. Some rental companies may require you to purchase additional insurance, while others may accept your existing State Farm coverage. It’s important to check with both your agent and the rental company before renting a truck to ensure you have proper coverage.

If you’re using the rental truck for business purposes, you may need to purchase separate commercial vehicle insurance. Again, it’s important to check with your agent and the rental company to ensure you have appropriate coverage.

If you have rental truck coverage through State Farm, your policy should cover any damages or injuries resulting from an accident. However, you’ll still need to pay your deductible and follow the proper claims process.

Overall, it’s important to review your State Farm policy and check with your agent before renting a truck to ensure you have appropriate coverage. By being proactive and asking the right questions, you can avoid any surprises or unexpected expenses down the road.