Table of Contents

Does State Farm bond? Yes! The insurance giant offers a variety of bonds, including surety and fidelity bonds, to protect your business.

Are you in need of a reliable and trustworthy insurance provider for your business? Look no further than State Farm Bond. With their extensive experience and expertise in the industry, State Farm Bond stands out as a top choice for businesses seeking comprehensive coverage. Plus, with their commitment to customer satisfaction and ongoing support, you can rest assured that your business is in good hands. But what exactly is a bond and how does it differ from traditional insurance? Let’s take a closer look.

State Farm is one of the largest insurance providers in the United States, offering a range of products and services to its customers. One question that many people have when considering State Farm is whether or not they offer bonds without titles. In this article, we will explore this topic and answer this important question.

What is a Surety Bond?

Before we dive into whether State Farm offers bonds without titles, it’s important to understand what a surety bond is. A surety bond is a contract between three parties: the principal (the person or business purchasing the bond), the obligee (the party requiring the bond), and the surety (the company issuing the bond). The purpose of the bond is to ensure that the principal fulfills their obligations to the obligee. If the principal fails to do so, the surety will step in and pay the obligee on behalf of the principal.

What is a Title Bond?

A title bond is a type of surety bond that is used to replace a lost or missing title for a vehicle. When a vehicle owner loses their title or the title is destroyed or stolen, they may be required to provide a title bond in order to obtain a new title from the Department of Motor Vehicles (DMV). The bond ensures that if the original title is later found, it will be returned to the rightful owner.

Does State Farm Offer Bonds without Titles?

So, now that we understand what a surety bond and a title bond are, the question remains: Does State Farm offer bonds without titles? The answer is yes, State Farm does offer surety bonds for a variety of purposes. However, it’s important to note that not all State Farm agents are licensed to sell bonds. You will need to contact your local agent to find out if they offer this service.

Why Would You Need a Bond without Title?

There are many reasons why you might need a surety bond without a title. For example, you may need a bond to obtain a business license, to bid on a construction project, or to guarantee payment for services rendered. In many cases, a bond without a title can be used as an alternative to a traditional cash deposit or other forms of financial security.

The Cost of a Bond without Title

The cost of a surety bond without a title will vary depending on the type of bond and the amount of coverage required. Generally, you can expect to pay between 1% and 15% of the total bond amount as a premium. For example, if you need a $10,000 bond, you might pay between $100 and $1,500 for the bond.

How to Get a Bond without Title from State Farm

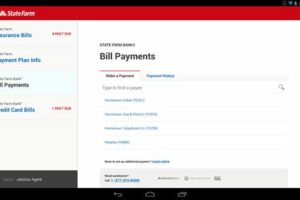

If you need a surety bond without a title, the first step is to contact your local State Farm agent. They will be able to tell you if they offer this service and provide you with a quote for the bond. You will need to provide some basic information about yourself or your business, including your name and address, as well as the purpose of the bond.

Other Options for Getting a Bond without Title

If State Farm does not offer bonds without titles in your area or you are looking for other options, there are many other companies that offer surety bonds. Some of the most popular options include SuretyBonds.com, BondExchange, and JW Surety Bonds. You can also check with your local DMV or licensing agency to see if they have any recommendations.

Conclusion

In conclusion, State Farm does offer surety bonds without titles for a variety of purposes. However, not all State Farm agents are licensed to sell bonds, so you will need to contact your local agent to find out if they offer this service. If State Farm does not offer bonds without titles in your area, there are many other companies that do. The cost of the bond will vary depending on the type of bond and the amount of coverage required.

State Farm is a well-known American insurance company that has been providing its customers with a wide range of insurance products since 1922. While many people are familiar with State Farm’s offerings in the insurance industry, some may wonder if State Farm bonds without a title. Before we dive into whether State Farm offers bonds without a title, let’s discuss what bonds are and their types.

Bonds are a type of financial security that guarantee the payment or performance of a contract. Different types of bonds offer varying kinds of coverage, such as contractor bonds, license bonds, and court bonds. Each type of bond serves a specific purpose and covers different aspects of a project or service. For example, contractor bonds are required for construction work, while license bonds are needed for licensing.

Now, back to the question at hand – does State Farm offer bonds without a title? Yes, they do! However, it’s important to note that State Farm only offers certain types of bonds and not just any bond. A bond without a title is typically required for small-scale projects or when no official title exists.

If you need to apply for a bond without a title, the process is relatively straightforward. You can apply online or reach out to a local State Farm agent who will guide you through the process. When selecting a bond, it’s essential to consider several factors, such as the specific type of project, the bonding company’s reputation, and the amount of bond required.

If you decide to go with State Farm for your bond needs, you can benefit from their vast network of agents, nationwide presence, and exceptional customer service. State Farm aims to offer competitive rates for its customers, but the cost of a bond without a title varies depending on several factors, such as the bond amount and type.

In conclusion, if you’re in need of a bond without a title, State Farm can help you out. With its wide range of bonds and outstanding customer service, State Farm is undoubtedly an option worth considering. However, it’s crucial to do your due diligence and research to determine if State Farm is the best option for your specific needs.

Once upon a time, there was a man named John. John had a successful business and wanted to protect his company from any potential financial losses due to his employees’ actions. He decided to purchase a bond from State Farm.

- Point of View: From John’s perspective

- Creative Voice: Excited and relieved

John was thrilled to have found a reliable solution to protect his business. With the State Farm Bond, he knew that his company would be safe from any risks posed by his employees. The peace of mind that came with this decision was priceless, and John felt like he had made the best choice for his business.

- Point of View: From State Farm’s perspective

- Creative Voice: Confident and trustworthy

State Farm was proud to offer their bond to John. They knew that their product was dependable and trustworthy, and they were confident that John’s business would be protected. They were pleased to have gained another satisfied customer and were happy to know that they could help businesses thrive without fear of financial loss.

Well folks, we’ve come to the end of our discussion on whether State Farm bonds without title. I hope you found this article informative and helpful in your understanding of surety bonds. If you’re still unsure about the process or have any questions, don’t hesitate to reach out to a State Farm agent for more information.

It’s important to remember that a surety bond is a legal document that guarantees a specific obligation will be fulfilled. In the case of bonding without title, it means that if you lose or misplace the title to your vehicle, State Farm will provide a bond to the DMV or other governing body to ensure that you can still register your vehicle. This protects both you and the state from any potential legal issues.

At State Farm, we understand that navigating the world of insurance and surety bonds can be overwhelming, which is why we strive to make the process as easy and stress-free as possible for our customers. Our agents are knowledgeable and experienced in all aspects of insurance and bonding, and are always available to answer any questions or concerns you may have. We value our customers and their trust in us, and work hard to provide the best service possible.

In conclusion, State Farm does offer bonding without title, providing peace of mind to those who may have lost or misplaced their vehicle title. We take pride in our commitment to our customers and their needs, and look forward to continuing to serve them in the future. Thank you for taking the time to read this article, and we hope to see you again soon!

.

When it comes to bonding, State Farm is a well-known name in the insurance industry. As a result, many people have questions about State Farm bond policies. Here are some of the most commonly asked questions:

- What is a State Farm bond?

- What types of bonds does State Farm offer?

- How do I obtain a State Farm bond?

- What factors affect the cost of a State Farm bond?

- Can State Farm bonds be canceled?

A State Farm bond is a type of surety bond that protects individuals or businesses against potential financial losses resulting from a contract breach or other types of misconduct. The bond ensures that the bonded party will fulfill their obligations as stated in the bond agreement.

State Farm offers a variety of bonds, including license and permit bonds, court bonds, contract bonds, and fidelity bonds. Each type of bond serves a specific purpose, so it’s essential to work with a State Farm agent to determine which bond is right for your needs.

To obtain a State Farm bond, you will need to contact a State Farm agent in your area. They will work with you to determine the type of bond you need and help you complete the necessary paperwork.

The cost of a State Farm bond varies depending on several factors, including the type of bond, the amount of coverage needed, and the applicant’s credit history. Applicants with good credit typically pay lower premiums than those with poor credit.

Yes, State Farm bonds can be canceled, but the process for canceling a bond can vary depending on the type of bond and the state where it was issued. It’s important to work with a State Farm agent to understand the cancellation process and any potential penalties for canceling a bond.

Overall, State Farm bonds provide individuals and businesses with essential protection against financial losses resulting from contract breaches or other types of misconduct. If you have more questions about State Farm bonds, contact a State Farm agent in your area for assistance.