Table of Contents

Discover if State Farm homeowners insurance covers hurricane damage. Protect your home with the right insurance coverage.

As hurricane season approaches, many homeowners are left wondering if their insurance policies will cover any potential damage caused by these powerful storms. State Farm, one of the largest insurers in the country, offers homeowners insurance that may provide coverage for hurricane damage. However, it is important to understand the specifics of your policy and what it covers. With the unpredictability of hurricanes, it’s crucial to be prepared and informed to ensure you have the necessary protection in place. Let’s take a closer look at what State Farm’s homeowners insurance policy covers when it comes to hurricane damage.

When a hurricane strikes, it can cause significant damage to your home. Homeowners insurance is an essential safeguard that protects you from unforeseen events such as hurricanes. State Farm is one of the leading providers of homeowners insurance in the United States. So, the question arises, does homeowners insurance cover hurricane damage State Farm? Let’s find out.

Homeowners insurance policies typically cover damages caused by natural disasters such as hurricanes, tornadoes, and windstorms. A standard policy may cover the cost of repairing or rebuilding your home, personal belongings, and additional living expenses if you need to relocate temporarily. However, the coverage may vary depending on your location, policy type, and the severity of the storm.

Hurricane damage coverage typically includes damages caused by strong winds, hail, and flooding. If your home sustains damage due to high winds or hail, your homeowners insurance policy will typically cover the cost of repairing or replacing damaged parts of your home and personal property. However, if your home suffers from flooding as a result of a hurricane, you’ll need flood insurance to cover the damages.

Flood insurance is a separate policy that covers damages caused by flooding, including those that result from hurricanes. It’s important to note that flood insurance is not included in standard homeowners insurance policies. You’ll need to purchase it separately through the National Flood Insurance Program (NFIP) or a private insurer. If you live in a high-risk flood zone, your mortgage lender may require you to have flood insurance.

Windstorm damage is covered under most homeowners insurance policies, including those provided by State Farm. This coverage includes damages caused by strong winds and gusts that result from hurricanes. However, some policies may include windstorm exclusions in areas that are frequently affected by hurricanes. Therefore, it’s important to review your policy carefully and ensure that you’re adequately covered.

If your home becomes uninhabitable due to hurricane damage, your homeowners insurance policy may cover additional living expenses. These expenses can include the cost of temporary housing, meals, and other necessary expenses. However, the coverage amount may vary depending on your policy limits, so it’s essential to review your policy and understand your coverage limits.

A deductible is the amount you’ll pay out of pocket for covered damages before your insurance policy kicks in. Homeowners insurance policies typically have a separate deductible for hurricane and windstorm damage. In some cases, the deductible may be a percentage of your home’s insured value rather than a fixed dollar amount. Therefore, it’s essential to understand your deductible and ensure that you have adequate savings to cover it in case of an emergency.

If your home sustains hurricane damage, it’s essential to file a claim with your insurance provider as soon as possible. You’ll need to provide documentation of the damages, including photographs and receipts for repairs. Your insurance adjuster will evaluate the damages and determine the coverage amount. It’s important to keep all receipts and documentation related to the damages and repairs to ensure that you receive the appropriate reimbursement.

While homeowners insurance can protect you from unforeseen events such as hurricanes, it’s essential to prepare your home and property before the storm hits. This includes securing loose items in your yard, trimming trees and branches, and reviewing your insurance policy to ensure that you have adequate coverage. Additionally, it’s essential to have an emergency kit ready, including food, water, and necessary supplies in case of an evacuation.

In conclusion, homeowners insurance from State Farm typically covers damages caused by hurricanes, windstorms, and other natural disasters. However, the coverage may vary depending on your location, policy type, and the severity of the storm. It’s important to review your policy carefully and ensure that you have adequate coverage to protect your home and property. Additionally, it’s essential to prepare your home and property before the storm hits to minimize damages and reduce the risk of injury or loss of life.

As a homeowner, it’s important to have a solid understanding of what is covered by your insurance policy in the event of a natural disaster like a hurricane. Homeowners insurance is a type of insurance that covers damage to your home and belongings caused by certain events, such as theft, fire, and storms. Hurricane damage refers specifically to the damage caused by strong winds and heavy rain associated with a hurricane.

There are different types of homeowners insurance coverage available, each with its own set of protections. Standard homeowners insurance typically covers damage to the structure of your home, as well as your personal property inside the home. It may also include liability coverage in case someone is injured on your property. However, it’s important to note that not all policies cover damage caused by hurricanes.

So, does State Farm cover hurricane damage? The answer is yes, they do. State Farm offers homeowners insurance policies that typically cover damage caused by hurricanes, including wind and hail damage. However, it’s important to read your policy carefully to understand exactly what is covered and what is not.

What is covered by State Farm hurricane insurance? In general, State Farm’s hurricane insurance covers damage to your home’s structure and personal property caused by wind, rain, and hail. This can include damage to your roof, windows, and siding, as well as damage to your furniture, electronics, and other belongings. It may also cover additional living expenses if you are forced to leave your home due to hurricane damage.

State Farm hurricane deductibles can vary depending on the specific policy you have. A deductible is the amount of money you will need to pay out-of-pocket before your insurance coverage kicks in. Hurricane deductibles can be higher than normal deductibles because hurricanes can cause more widespread damage than other types of storms.

It’s important to note that while homeowners insurance may cover damage caused by hurricanes, it typically does not cover damage caused by flooding. Hurricanes can cause both wind and flood damage, but these are two separate types of damage that require different types of insurance coverage. If you live in an area prone to hurricanes, it’s important to consider purchasing flood insurance as well.

The importance of hurricane preparedness cannot be overstated. While insurance coverage can help you recover financially from hurricane damage, it’s always best to take steps to prevent damage from occurring in the first place. This can include things like reinforcing your roof, windows, and doors, trimming trees around your home, and securing loose outdoor items.

If your home has been damaged by a hurricane, there are several steps you should take. First, make sure everyone in your household is safe and accounted for. Then, document the damage by taking photos and videos. Contact your insurance company as soon as possible to report the damage and begin the claims process.

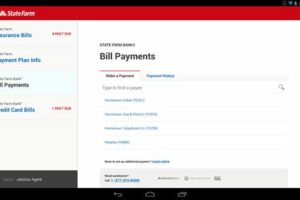

To file a State Farm hurricane damage claim, you can call their claims department or file a claim online through their website. You will need to provide information about the damage and any repairs that have already been made. An adjuster will then be sent to your home to assess the damage and determine the amount of your claim.

In conclusion, homeowners insurance can provide valuable protection in the event of hurricane damage. State Farm offers homeowners insurance policies that typically cover damage caused by hurricanes, including wind and hail damage. However, it’s important to understand exactly what is covered by your policy and to take steps to prevent damage from occurring in the first place. If your home has been damaged by a hurricane, contact your insurance company as soon as possible to begin the claims process.

Once upon a time, there was a homeowner named John who lived in a coastal city that was often hit by hurricanes. John knew the importance of having homeowners insurance but he wondered, does homeowners insurance cover hurricane damage State Farm?

- John decided to contact his State Farm agent to inquire about coverage for hurricane damage.

- The State Farm agent explained to John that their standard homeowners insurance policy does cover hurricane damage.

- The coverage includes damage caused by high winds, heavy rain, and flooding due to storm surges.

- However, it is important to note that not all policies are created equal and coverage may vary depending on the location and specific policy.

Relieved to hear this, John made sure to review his policy and make any necessary adjustments to ensure he had adequate coverage for potential hurricane damage.

Overall, it’s important for homeowners to understand their insurance coverage and to regularly review and update their policy as needed. In the case of hurricane damage, being properly insured can provide peace of mind and financial protection during a difficult time.

Hey there, dear readers! We hope you’ve found this blog post about whether homeowners insurance covers hurricane damage from State Farm helpful and informative. As the storm season approaches, it’s essential to know what your insurance policy covers and how you can protect your home and belongings.

After thorough research, we’ve discovered that State Farm offers hurricane coverage as part of its standard homeowners insurance policies. This coverage includes damages caused by high winds, hail, fallen trees, and other hurricane-related perils. However, it’s crucial to note that some exclusions apply, and it’s always best to review your policy and discuss any concerns with your insurance agent.

Remember, homeowners insurance doesn’t cover flooding caused by hurricanes or any other natural disasters. For that, you’ll need a separate flood insurance policy. It’s also crucial to take preventative measures like trimming trees, securing loose outdoor furniture, and reinforcing windows and doors to minimize potential damages and keep yourself and your family safe.

In conclusion, we hope this article has answered any questions you may have had about whether homeowners insurance covers hurricane damage from State Farm. Remember to review your policy, take preventative measures, and stay informed during storm season. Stay safe!

.

People also ask about whether Homeowners Insurance covers Hurricane Damage from State Farm:

-

Does State Farm cover hurricane damage?

Yes, State Farm Homeowners Insurance does cover hurricane damage. However, the extent of coverage depends on the specifics of your policy. Most policies will include coverage for wind damage, but flooding caused by the hurricane may require additional coverage.

-

What types of hurricane damage does State Farm cover?

State Farm Homeowners Insurance typically covers damage caused by high winds, falling trees or debris, and other damages related to hurricanes. However, it’s important to review your policy and understand what is specifically covered.

-

Does State Farm offer flood insurance?

Yes, State Farm offers flood insurance as a separate policy. Flood damage caused by hurricanes is not typically covered under standard homeowners insurance policies, so it may be worth considering adding flood insurance to your coverage.

-

What should I do if my home is damaged in a hurricane?

If your home is damaged in a hurricane, first make sure everyone is safe and seek medical attention if necessary. Then, contact your insurance company to report the damage and start the claims process. Take photos and document the damage as best you can to support your claim. Your insurance company will work with you to assess the damage and determine what repairs or replacements are covered under your policy.

-

What can I do to prepare for a hurricane?

It’s important to have a plan in place before a hurricane strikes. This can include securing loose items outside, boarding up windows, and having an emergency supply kit ready. Additionally, review your homeowners insurance policy to ensure you have adequate coverage for hurricane damage and consider adding flood insurance if you live in an area prone to flooding.

In summary, State Farm Homeowners Insurance does cover hurricane damage, but the specific coverage depends on your policy. It’s important to review your policy and understand what is covered and what additional coverage may be necessary, such as flood insurance. If your home is damaged in a hurricane, contact your insurance company to start the claims process and document the damage as best you can. Finally, prepare in advance for hurricanes by securing loose items, boarding up windows, and having an emergency supply kit ready.