Table of Contents

Wondering if your State Farm insurance covers theft? Read on to learn about their policies and how you can protect your belongings.

Are you worried about theft? It’s a common concern for many homeowners, especially those who own valuable possessions. But what happens if someone breaks into your home and steals your belongings? Does your State Farm insurance policy provide coverage for theft? If you’re a State Farm policyholder, you’ll want to know the answer to this question. Fortunately, we’ve got you covered. In this article, we’ll explore whether or not State Farm insurance covers theft and what you can do to protect your assets.

As a policyholder with State Farm Insurance, you may have wondered if your coverage includes theft without title. After all, car theft is a common crime that can happen to anyone, and it’s important to know what your insurance policy covers in the event that it happens to you. In this article, we’ll explore whether State Farm Insurance covers theft without title and what you can do to protect your vehicle from being stolen.

What is theft without title?

Theft without title, also known as Grand Theft Auto, is the act of stealing a vehicle without the owner’s permission or consent. The thief may use force or deception to gain access to the vehicle, and they do not have legal ownership of the vehicle. In some cases, the thief may attempt to sell the stolen vehicle to an unsuspecting buyer, which can lead to legal complications for the buyer if the vehicle’s title is not legitimate.

Does State Farm Insurance cover theft without title?

State Farm Insurance offers comprehensive coverage for vehicle theft, which includes theft without title. If your car is stolen and you have comprehensive coverage on your policy, State Farm will pay to replace your vehicle up to the current market value. However, it’s important to note that this coverage does not include any personal belongings that may have been stolen along with the vehicle.

How can I protect my vehicle from theft?

While State Farm Insurance provides coverage for vehicle theft, it’s always a good idea to take preventative measures to protect your vehicle from being stolen in the first place. Here are some tips:

- Always lock your vehicle and keep windows closed when parked

- Don’t leave keys in the ignition or anywhere else in the car

- Park in well-lit areas or in a garage if possible

- Install an alarm system or other anti-theft device

What should I do if my car is stolen?

If your car is stolen, the first thing you should do is contact the police and file a report. This will help the police track down your vehicle and increase the chances of it being recovered. You should also contact State Farm Insurance to file a claim and report the theft. They will guide you through the claims process and provide any necessary documentation.

Are there any exclusions to theft coverage?

While State Farm Insurance does cover theft without title, there are some exclusions to coverage that policyholders should be aware of. For example, if the theft was a result of fraud or misrepresentation, the claim may be denied. Additionally, if the vehicle was left unattended with the keys in the ignition, the claim may be denied. It’s important to review your policy carefully and understand any exclusions or limitations to coverage.

What other types of coverage does State Farm Insurance offer?

In addition to comprehensive coverage for vehicle theft, State Farm Insurance offers a variety of other types of coverage. These include:

- Liability coverage

- Collision coverage

- Uninsured/underinsured motorist coverage

- Medical payment coverage

- Rental reimbursement coverage

- Roadside assistance coverage

How can I find out more about my State Farm Insurance policy?

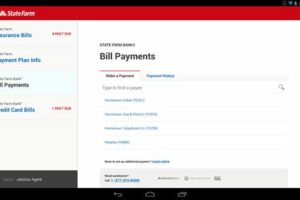

If you have questions about your State Farm Insurance policy or want to make changes to your coverage, you can contact your local State Farm agent. They will be able to answer any questions you may have and help you make informed decisions about your coverage.

Conclusion

In conclusion, State Farm Insurance does cover theft without title as part of their comprehensive coverage for vehicle theft. However, it’s always a good idea to take preventative measures to protect your vehicle from being stolen in the first place. If your car is stolen, be sure to contact the police and State Farm Insurance to file a claim and report the theft. Review your policy carefully to understand any exclusions or limitations to coverage, and don’t hesitate to contact your local State Farm agent if you have any questions or concerns.

If you’re a State Farm Insurance customer, you may be wondering if your policy covers theft. State Farm is one of the largest insurance providers in the United States, offering a range of coverage options for homeowners, renters, and drivers. In this article, we’ll take a closer look at State Farm’s theft coverage policies and answer some common questions.

First, it’s important to understand what theft without title means. This type of theft occurs when someone steals property that doesn’t have a title, such as electronics, jewelry, or other valuables. Unlike theft of a car or motorcycle, which is covered under auto insurance policies, theft without title is typically covered under homeowners or renters insurance.

So what does State Farm Insurance cover when it comes to theft without title? In general, State Farm offers coverage for theft of personal property as part of its homeowners and renters insurance policies. This means that if someone steals your jewelry, electronics, or other items from your home or apartment, you may be able to file a claim with State Farm for reimbursement.

However, it’s important to note that not all theft claims are automatically covered by State Farm. The company may deny your claim if it determines that the theft was caused by negligence on your part or if you don’t have adequate documentation to prove the value of the stolen items.

So, will State Farm Insurance cover theft without title? The answer is yes, but there are some limitations. As mentioned, the company may deny your claim if certain conditions aren’t met. Additionally, there may be limits on the amount of coverage available for theft, so it’s important to review your policy carefully.

If you’re concerned about the limits of your current policy, you may be able to add additional coverage for theft without title. State Farm offers a range of optional coverage options, including personal article insurance, which can provide additional protection for high-value items like jewelry and art.

If you do need to file a theft claim with State Farm, it’s important to follow the company’s claim procedures carefully. This typically involves providing documentation of the stolen items, including receipts, appraisals, or photographs. You’ll also need to file a police report and cooperate with any investigations conducted by State Farm.

Of course, the best way to deal with theft without title is to prevent it from happening in the first place. Some tips for preventing theft include keeping your valuables out of sight, installing security systems, and being cautious about who you let into your home or apartment. By taking these steps, you can reduce the likelihood of becoming a victim of theft and avoid the hassle of filing a claim with State Farm.

If you do need to file a claim, there are some tips you should keep in mind. First, be sure to document everything related to the theft, including the date and time it occurred, the items that were stolen, and any other relevant details. You should also keep copies of all documents related to the claim, including receipts, police reports, and correspondence with State Farm.

In conclusion, State Farm Insurance does offer coverage for theft without title, but there are some limitations and conditions that may apply. If you’re a State Farm customer, it’s important to review your policy carefully and consider adding additional coverage if necessary. By following the company’s claim procedures and taking steps to prevent theft, you can protect yourself and your property and ensure that you have the coverage you need when you need it.

Overall, State Farm Insurance is a good choice for coverage, with a range of options available for homeowners, renters, and drivers. Whether you’re concerned about theft or other types of damage to your property, State Farm can provide the peace of mind you need to feel secure. Just be sure to review your policy and take steps to prevent theft, and you’ll be well on your way to enjoying the benefits of State Farm’s coverage.

Finally, it’s worth noting that theft insurance is an important consideration for anyone who owns property. Whether you’re a homeowner, renter, or driver, theft can happen at any time, and it can be devastating to deal with the aftermath. By choosing a reputable insurance provider like State Farm and taking steps to protect your property, you can minimize the risk of theft and ensure that you’re prepared if it does occur.

As a State Farm insurance policyholder, one of the most common questions that come to mind is, Does My State Farm Insurance Cover Theft?

Storytelling:

John Smith had been a loyal State Farm customer for over a decade. He had never filed a claim before, but one day, he came back to his home to find out that it had been broken into, and some of his valuable items were missing.

John was devastated and didn’t know what to do. He immediately called his State Farm agent to find out if his policy covered theft. The agent assured him that his homeowner’s insurance policy would cover the stolen items, and they would begin the claims process right away.

John was relieved to hear that his policy would cover the theft. Over the next few days, he worked with his State Farm agent to gather all the necessary information and documentation needed to file a claim.

Within a week, John received a check from State Farm that covered the value of the stolen items. He was grateful for the quick and efficient service provided by State Farm and knew that he had made the right choice in choosing them as his insurance provider.

Point of View:

When it comes to insurance coverage, it’s always essential to understand what your policy covers and what it doesn’t. As a State Farm policyholder, you can rest assured that theft is covered under your homeowner’s insurance policy.

State Farm understands the importance of protecting your home and valuables from unexpected events like theft. That’s why they offer comprehensive homeowner’s insurance policies that cover a wide range of perils, including theft.

If you ever find yourself in a situation where your home has been broken into and your valuable items have been stolen, you can count on State Farm to help you get back on your feet. Their claims process is straightforward and efficient, and they will work with you every step of the way to ensure that your claim is handled quickly and fairly.

Conclusion:

Whether you’re a long-time State Farm customer like John or considering becoming one, it’s always essential to understand what your policy covers. If you’re ever unsure about whether your policy covers theft or any other peril, don’t hesitate to reach out to your State Farm agent for clarification.

Remember, State Farm has been providing reliable insurance coverage to policyholders for over 90 years. They understand the importance of protecting what matters most to you and will always be there when you need them most.

- State Farm insurance policy covers theft under their homeowner’s insurance policy

- The claims process is quick and efficient

- State Farm offers comprehensive homeowner’s insurance policies that cover a wide range of perils including theft

- If you are ever unsure if your policy covers theft, contact your State Farm agent for clarification

Hello there, dear readers! I hope you found this article informative and helpful in understanding whether State Farm Insurance covers theft without title. As we have discussed, the answer to this question depends on various factors such as the type of policy you have and the circumstances surrounding the theft.

It is important to remember that insurance policies can be complex, and it can be challenging to navigate them without proper knowledge and guidance. That’s why it’s always a good idea to consult with your insurance agent or representative if you have any doubts or questions about your coverage.

At State Farm, we strive to provide our customers with the best possible service and support when it comes to protecting their assets from theft. We understand how devastating it can be to have something stolen from you, which is why we offer comprehensive coverage options that can help you get back on your feet.

In conclusion, when it comes to theft without title, State Farm Insurance may provide coverage under certain conditions. However, it’s crucial to review your policy and speak with your representative to ensure that you have the right coverage for your needs. Thank you for reading, and we hope to continue to be your trusted partner in protecting what matters most to you.

.

People also ask about Does My State Farm Insurance Cover Theft?

- What types of theft does State Farm insurance cover?

- Does State Farm insurance cover stolen cars?

- What should I do if my personal belongings are stolen?

- Will my State Farm insurance cover theft while traveling?

- How can I make sure I have enough coverage for theft?

State Farm offers coverage for theft of personal property, including theft from a vehicle, theft from a home, and theft of personal belongings while traveling.

Yes, State Farm offers comprehensive coverage that can help protect your car against theft. If your car is stolen, you’ll need to file a police report and contact your State Farm agent to start the claims process.

If your personal belongings are stolen, you should first file a police report. Then, contact your State Farm agent to report the theft and start the claims process. Be sure to provide any documentation you have, such as receipts or photos of the stolen items.

Yes, State Farm offers coverage for theft of personal belongings while traveling. This coverage is typically included in your homeowners or renters insurance policy.

You can review your State Farm insurance policy with your agent to make sure you have adequate coverage for theft. You may also want to consider adding additional coverage, such as a personal articles policy, to protect high-value items like jewelry or electronics.