Table of Contents

Curious if State Farm always lists wrecks as date of loss? Read on to understand how insurance companies determine the date of loss for your claim.

If you’ve ever been in a car accident and filed a claim with State Farm, you may have noticed that the date of loss listed on your claim isn’t always the date of the accident. In fact, State Farm may list a different date entirely as the date of loss. This can be confusing and frustrating for policyholders who are trying to keep track of their claim and understand their coverage. So, why does State Farm do this? And does it always list wrecks as the date of loss? Let’s explore this topic further.

Firstly, it’s important to understand that the date of loss listed on a claim is not necessarily the same as the date of the accident itself. State Farm uses this term to refer to the date on which the policyholder suffered a financial loss as a result of the accident. This could include things like damage to the vehicle, medical expenses, or lost wages. Depending on the circumstances of the accident, the date of loss may be different from the date of the actual collision.

Secondly, State Farm does not always list wrecks as the date of loss. In fact, there are many factors that can influence the determination of the date of loss, including the type of coverage the policyholder has, the extent of the damages, and the policy language itself. For example, if a policyholder has collision coverage and their vehicle is damaged in an accident, the date of loss may be the date on which the damage occurred, rather than the date of the collision itself.

Overall, understanding the nuances of how insurance companies like State Farm determine the date of loss can be complex. If you’re ever unsure about the details of your claim or coverage, it’s always a good idea to reach out to your insurance provider directly for clarification.

State Farm is one of the largest insurance providers in the United States. It’s no secret that car accidents are a common occurrence, which is why State Farm is always on standby to provide assistance to people who have been involved in a wreck. One question that many people ask is whether State Farm always lists wrecks as date of loss. In this article, we will explore this topic in-depth and provide you with all the information you need to know.

What is Date of Loss?

Date of Loss is a term used by insurance companies to refer to the date when an accident or incident occurred. It is an important date because it determines when coverage begins, and when any claims should be filed. The Date of Loss is usually the starting point for any insurance claim, and it is used to calculate how much compensation a policyholder is entitled to receive.

What Happens after an Accident?

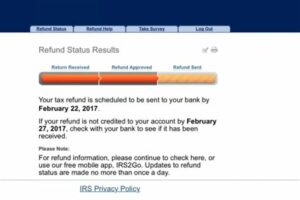

If you have been involved in an accident, the first thing you should do is contact your insurance company. State Farm has a 24-hour claims center that is always available to assist you. When you call, you will be asked to provide details about the accident, including the Date of Loss. State Farm will then send an adjuster to assess the damage to your vehicle and determine the extent of your coverage.

Does State Farm Always List Wrecks as Date of Loss?

The answer to this question is not a simple yes or no. State Farm generally lists the Date of Loss as the date when the accident occurred, which is usually the date that the police report was filed. However, there are situations where this may not be the case. For example, if you were involved in a hit-and-run accident and there were no witnesses, it may be difficult to determine the exact date of the accident. In such cases, State Farm may use the date when you reported the incident to them as the Date of Loss.

Why is the Date of Loss Important?

The Date of Loss is important because it determines when coverage begins and when any claims should be filed. For example, if your policy has a deductible of $500 and your Date of Loss is on January 1st, you will be responsible for paying the first $500 of any damage caused by the accident. If you file a claim after January 1st, any damage caused by the accident will be covered by your insurance company.

What Happens if the Date of Loss is Incorrect?

If the Date of Loss is incorrect, it can cause problems when filing a claim. For example, if you file a claim after the deadline has passed, your claim may be denied. It is important to ensure that the Date of Loss is accurate to avoid any complications when filing a claim. If you believe that the Date of Loss listed by State Farm is incorrect, you should contact them immediately to have it corrected.

How Can You Find the Date of Loss?

If you are unsure about the Date of Loss, you can contact State Farm and ask them for the information. They will be able to provide you with the date that they have on file. You can also check your policy documents or any correspondence from State Farm to see if the Date of Loss is listed. If you still cannot find the information, you should contact State Farm for assistance.

Conclusion

In conclusion, the Date of Loss is an important term used by insurance companies to refer to the date when an accident or incident occurred. State Farm generally lists the Date of Loss as the date when the accident occurred, but there may be situations where this is not the case. It is important to ensure that the Date of Loss is accurate to avoid any complications when filing a claim. If you have any questions or concerns about the Date of Loss, you should contact State Farm for assistance.

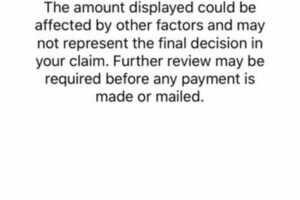

Introducing the Debate: Does State Farm Always List Wrecks as Date of Loss?The date of loss is a crucial factor in processing insurance claims. It is the date on which an incident occurred, resulting in damage or loss to the insured property. For State Farm, accurately identifying the date of loss is essential for determining coverage and assessing liability. However, there is a debate among policyholders about whether State Farm always lists wrecks as the date of loss. Let’s examine State Farm’s process for identifying the date of loss, understand why it is critical, and explore the common factors that impact whether State Farm lists wrecks as the date of loss.Examining State Farm’s Process for Identifying Date of LossState Farm assesses the date of loss based on several factors. These include the date when the accident occurred, the date when the insured reported the incident, and the date when the insurer received the claim. State Farm also considers the type of loss, such as a car accident, theft, or weather-related damage. The insurer may also consult with third-party experts, such as mechanics, engineers, and adjusters, to determine the date of loss accurately.Understanding Why Accurate Date of Loss is Critical for State FarmAccurately dating a wreck is essential for State Farm to determine liability, coverage, and settlement amounts. If State Farm lists an incorrect date of loss, it can lead to disputes between the insurer and the policyholder, prolonging the claims process and adding to the cost of resolving the claim. Accurate dating of a wreck can also help State Farm identify patterns of loss, detect fraudulent claims, and improve its risk assessment models.Common Factors That Impact Whether State Farm Lists Wrecks as Date of LossSeveral factors can influence whether State Farm lists a wreck as the date of loss. One of the most significant factors is the insured’s reporting of the incident. If the insured fails to report an accident promptly, it can lead to discrepancies in the date of loss. The severity of the damage can also impact State Farm’s determination of the date of loss. If a vehicle is deemed a total loss, the date of loss may be the date of the accident, rather than the date when the insurer declares the vehicle a total loss.Debate: Does State Farm Always List Wrecks as Date of Loss, and Why?There is no clear answer to whether State Farm always lists wrecks as the date of loss. In some cases, State Farm may list the date of accident as the date of loss, especially if the damage is severe and the vehicle is declared a total loss. However, there are instances where State Farm may not list a wreck as the date of loss. For example, if the insured fails to report the accident promptly, or if there are discrepancies in the incident report, State Farm may use a different date of loss.Reasons Why State Farm May Not List a Wreck as Date of LossState Farm may not list a wreck as the date of loss for several reasons. One reason may be that the insured failed to report the accident promptly, leading to discrepancies in the incident report. Another reason may be that the insured did not provide sufficient information about the incident, making it difficult for State Farm to determine the date of loss accurately. Additionally, State Farm may use a different date of loss if the insured has a history of filing fraudulent claims or if there are suspicions of fraud.The Importance of Accurately Dating a Wreck for Insurance Claim PurposesAccurately dating a wreck is critical for insurance claim purposes. It ensures that the policyholder receives the appropriate coverage and that the insurer assesses liability correctly. Accurate dating of a wreck can also help prevent disputes between the insurer and the policyholder, reducing the cost and time required to resolve a claim. For policyholders, it is essential to provide accurate and timely information about the incident to ensure that their claims are processed correctly.When Date of Loss Discrepancies Can Impact Your Insurance ClaimDiscrepancies in the date of loss can impact your insurance claim in several ways. If State Farm lists an incorrect date of loss, it can affect the amount of coverage you receive, the settlement amount, and the time it takes to resolve the claim. It can also lead to disputes between you and the insurer, delaying the claims process and adding to the cost of resolving the claim. Therefore, it is crucial to ensure that the date of loss is accurately listed in your claim.Steps You Can Take to Ensure Your Insurance Claim is Accurately Processed by State FarmThere are several steps you can take to ensure that your insurance claim is accurately processed by State Farm. First, report the incident to State Farm as soon as possible. Provide all relevant and accurate information about the incident, including the date, time, and location of the accident. Cooperate with State Farm’s investigation and provide any additional information or documentation they may require. If there are discrepancies in the incident report, work with State Farm to resolve them promptly.Conclusion: Understanding How State Farm Identifies Wrecks as Date of LossIn conclusion, accurately identifying the date of loss is critical for State Farm to determine coverage, assess liability, and settle claims. While State Farm may not always list wrecks as the date of loss, it uses a comprehensive process to determine the date accurately. As a policyholder, it is essential to provide timely and accurate information about the incident to ensure that your claim is processed correctly. By understanding how State Farm identifies wrecks as the date of loss, you can ensure that your claims are resolved quickly and efficiently.

Once upon a time, there was a man named John who had recently gotten into a car accident. He had State Farm insurance and was wondering if the date of loss listed on his policy would always be the same as the date of the wreck.

- From John’s point of view, he felt confused and unsure about what to expect from his insurance company.

- He had heard some rumors that insurance companies might try to manipulate dates to avoid paying out claims.

- However, John decided to give State Farm the benefit of the doubt and call them to ask about their policies.

When John spoke to a representative at State Farm, he was relieved to find out that they do indeed list wrecks as the date of loss.

- The representative explained that this is standard practice in the insurance industry and helps ensure that claims are processed fairly and accurately.

- They also assured John that State Farm is committed to providing excellent customer service and would never try to cheat him out of his rightful compensation.

- John was grateful for the information and felt much more confident about his insurance coverage going forward.

In the end, John learned that he could trust State Farm to handle his claim with integrity and honesty. He was glad to have chosen a company that puts its customers first and would recommend them to anyone looking for reliable insurance coverage.

Greetings to all the visitors who happened to stop by and read this article about whether State Farm always lists wrecks as the date of loss. We hope you found our analysis informative and helpful in clearing any doubts and concerns about the topic at hand. Before we wrap up, let us summarize what we have learned so far.

Firstly, it is a common misconception that State Farm always lists wrecks as the date of loss. While it may be true that in most cases, the date of loss is the same as the accident date, it is not always the case. The date of loss can vary depending on the type of claim and the policyholder’s specific circumstances. As we have discussed, State Farm considers several factors such as theft, vandalism, natural disasters, and even minor damages when determining the date of loss.

Secondly, we have also learned that it is essential to provide accurate information to your insurer when filing a claim. Not only can providing false information result in the denial of your claim, but it can also lead to legal consequences. Therefore, it is crucial to be honest and transparent with your insurer to ensure a smooth and fair claims process.

In conclusion, we hope that this article has helped shed some light on the question of whether State Farm always lists wrecks as the date of loss. Remember, while a wreck is a common cause for an insurance claim, it is not the only one. It is always best to consult with your policy and insurer to understand the specifics of your coverage and claims process. Thank you for reading, and we wish you all the best in your future insurance endeavors!

.

People often wonder if State Farm always lists wrecks as the date of loss. Here are some common questions and answers about this topic:

-

What is the date of loss in an insurance claim?

The date of loss is the date when damage or loss occurs to the property or vehicle covered by an insurance policy.

-

Does State Farm always list wrecks as the date of loss?

No, State Farm does not always list wrecks as the date of loss. The date of loss can vary depending on the circumstances of the claim. For example, if a car is stolen and later recovered with damage, the date of loss would be the date of the theft, not the date of the wreck.

-

Why do people think that State Farm always lists wrecks as the date of loss?

There may be a misconception that State Farm always lists wrecks as the date of loss because many claims involve car accidents. However, this is not always the case.

-

How does the date of loss affect an insurance claim?

The date of loss is important because it determines when coverage under the insurance policy begins. It also affects how much the insurance company will pay for damages or losses.

-

What should I do if I disagree with the date of loss on my State Farm claim?

If you disagree with the date of loss listed on your State Farm claim, you should contact your insurance agent or representative to discuss the issue. They may be able to provide more information about how the date of loss was determined and help you resolve any disputes.

Overall, it’s important to remember that the date of loss can vary depending on the circumstances of a claim. While car accidents may be a common reason for making an insurance claim, they are not the only factor that determines the date of loss. If you have any questions or concerns about your State Farm claim, don’t hesitate to reach out to your insurance representative for assistance.