Table of Contents

Wondering if you can depreciate your farm animals for tax purposes? Learn about the rules and regulations for agriculture depreciation here.

Can You Depreciate Farm Animals? Well, the answer to this question might surprise you. As farmers and ranchers, you may have come across a situation where you bought or sold livestock animals, and you’re wondering if you can depreciate them for tax purposes. The good news is that the IRS allows farmers and ranchers to depreciate certain types of livestock animals over a period of years. However, there are specific rules and regulations you need to follow to ensure that you’re eligible to depreciate your farm animals.

Before we delve into the details of how to depreciate your farm animals, let’s first make sure we’re on the same page about what depreciation means. Depreciation is a tax deduction that allows you to recover the cost of certain property over time. Essentially, it recognizes that assets, like your farm animals, lose value over time due to wear and tear, obsolescence, or other factors. By taking depreciation deductions, you can reduce your taxable income and lower your tax bill.

Now, let’s get back to the question at hand: Can You Depreciate Farm Animals? The answer is yes, but with some caveats. First, the animals must be used in your farming business, and they must have a useful life of more than one year. This means that you can’t depreciate animals that you plan to sell within a year or those that you keep solely for personal use. Additionally, the IRS has specific rules for determining the useful life of different types of farm animals, which we’ll discuss in more detail below.

As a farmer or rancher, you may wonder if you can depreciate your farm animals. According to the IRS, farm animals can be depreciated if they are used for breeding, dairy, draft, or sporting purposes. However, the rules and regulations surrounding depreciation of farm animals can be quite complex. In this article, we will explore the topic of depreciating farm animals and provide you with some useful information that can help you navigate this area of tax law.

What is Depreciation?

What is Depreciation?

Depreciation is an accounting method used to allocate the cost of an asset over its useful life. It is intended to reflect the decline in value of an asset over time due to wear and tear, obsolescence, or other factors. For tax purposes, depreciation is a deduction that allows taxpayers to recover the cost of certain assets over time.

Types of Farm Animals

Types of Farm Animals

Farm animals come in many shapes and sizes, and they serve a variety of purposes on the farm. Some common types of farm animals include:

- Cows: used for dairy or beef production

- Horses: used for draft or riding purposes

- Chickens: used for egg or meat production

- Pigs: used for pork production

- Sheep: used for wool or meat production

Farm Animal Depreciation Rules

Farm Animal Depreciation Rules

The IRS has specific rules and regulations regarding the depreciation of farm animals. In general, farm animals can be depreciated if they are used for breeding, dairy, draft, or sporting purposes. However, there are some exceptions to this rule.

If you purchased a farm animal for breeding purposes, you can depreciate it over its useful life. The useful life of a farm animal is typically determined by its breeding life. For example, if you purchase a cow for breeding purposes, you may be able to depreciate it over a period of five years.

If you purchased a farm animal for dairy or draft purposes, you can also depreciate it over its useful life. The useful life of a farm animal used for dairy or draft purposes is typically determined by its productive life. For example, if you purchase a horse for draft purposes, you may be able to depreciate it over a period of ten years.

Exceptions to Depreciation Rules

Exceptions to Depreciation Rules

There are some exceptions to the general depreciation rules for farm animals. For example, if you purchase a farm animal for sporting purposes, you may not be able to depreciate it. The IRS considers farm animals used for sporting purposes to be personal property that is not used in a trade or business.

In addition, if a farm animal dies or is sold before the end of its useful life, you may have to recapture some or all of the depreciation that you claimed on your tax return. This can result in additional taxes and penalties.

Recording Depreciation of Farm Animals

Recording Depreciation of Farm Animals

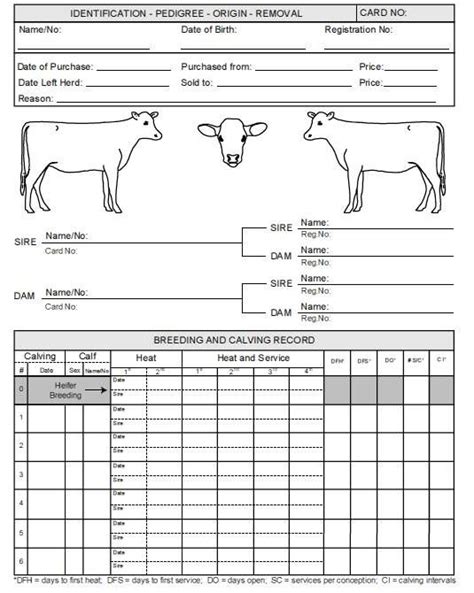

If you plan to depreciate your farm animals, you will need to keep accurate records of your purchases and sales. You will also need to keep track of the useful life of each animal and the amount of depreciation that you claim on your tax return.

It is important to note that depreciation of farm animals is subject to certain limitations and restrictions. For example, you may only be able to depreciate a certain percentage of the cost of the animal each year. In addition, you may not be able to claim depreciation on certain types of animals, such as those used for breeding that are over a certain age.

Tax Benefits of Depreciating Farm Animals

Tax Benefits of Depreciating Farm Animals

The tax benefits of depreciating farm animals can be significant. By claiming depreciation on your tax return, you can reduce your taxable income and lower your overall tax liability. This can help you save money and reinvest in your farm or ranch.

In addition, depreciating your farm animals can help you plan for the future. By knowing the useful life and depreciation schedule of your animals, you can better plan for replacements and upgrades. This can help you maintain a healthy and productive herd or flock over the long term.

Consult with a Tax Professional

Consult with a Tax Professional

If you are planning to depreciate your farm animals, it is important to consult with a tax professional. A qualified accountant or tax attorney can help you navigate the complex rules and regulations surrounding farm animal depreciation and ensure that you are in compliance with all applicable laws.

Overall, the ability to depreciate farm animals can provide significant tax benefits for farmers and ranchers. However, it is important to understand the rules and limitations surrounding this area of tax law and to keep accurate records of your purchases and sales. By working with a qualified tax professional, you can ensure that you are taking full advantage of the tax benefits available to you and protecting your financial future.

The purpose of depreciating farm animals is to account for the decrease in their value over time. Just like any other asset, farm animals are subject to wear and tear, aging, and market fluctuations that can affect their worth. Understanding the reasoning behind the need to account for depreciation of living assets is crucial for farmers to make informed decisions about their operations. There are various types of farm animals that are depreciable, including cattle, pigs, sheep, goats, horses, and poultry. Farmers can include these animals as depreciable assets in their accounting records to reflect their true value. Depreciation rates for different types of animals vary depending on several factors such as age, breed, and market demand. For example, dairy cows are generally depreciated over five years, while beef cattle can be depreciated over seven years. Hogs are typically depreciated over three years, and horses can be depreciated over 10 years. Calculating the cost of depreciation involves tracking the animal’s purchase price, estimated useful life, and salvage value. The cost of animal depreciation can significantly impact profitability, and farmers must consider this when making investment decisions. There are several methods that agricultural businesses can use to account for the depreciation of animals, such as straight-line depreciation and declining balance depreciation. Straight-line depreciation spreads the cost of an asset evenly over its estimated useful life, while declining balance depreciation front-loads the depreciation expense. Tracking and monitoring animal depreciation over time is essential for farmers to make informed decisions. They can use tools such as spreadsheets or specialized software to keep accurate records of their livestock’s value. Several factors influence the depreciation of farm animals, including age, breed, and market demand. Farmers must also consider legal implications when accounting for animal depreciation on tax returns and compliance with local laws. Depreciating living farm assets presents unique challenges as farmers deal with unpredictable mortality rates and market prices. Strategies for mitigating animal depreciation costs include improving animal health, reducing feed costs, and diversifying the operation to reduce dependence on a single market. In conclusion, understanding the purpose, types, rates, calculation, methods, tracking, factors, legal considerations, challenges, and strategies for mitigating animal depreciation costs is crucial for farmers to make informed decisions about their operations. By accounting for animal depreciation, they can accurately reflect their true value and make sound investment decisions to increase profitability.

Once upon a time, there was a farmer named John who owned a large farm with various animals. He had cows, horses, pigs, and chickens. One day, John wondered if he could depreciate his farm animals for tax purposes.

Here are some points of view about whether or not you can depreciate farm animals:

- Yes, you can depreciate farm animals:

- No, you cannot depreciate farm animals:

- It depends on the specific circumstances:

According to the IRS, farm animals can be depreciated as long as they are being used for business purposes. This means that if John uses his cows for milk production or his pigs for meat production, he can depreciate them over their useful life.

Depreciation allows John to deduct a portion of the animal’s cost each year on his tax return, which can decrease his overall taxable income and increase his tax savings.

Some accountants argue that farm animals cannot be depreciated because they are living beings and do not have a fixed useful life. Unlike machinery or equipment, animals can get sick, die, or become unproductive, which makes it difficult to determine their exact value and useful life.

Additionally, the IRS has strict rules about when and how depreciation can be taken, which can make it complicated for farmers to accurately calculate and report their deductions.

The answer to whether or not farm animals can be depreciated depends on various factors, such as the type of animal, its intended use, and the farmer’s accounting method.

For example, dairy cows may have a longer useful life than beef cattle, which means they can be depreciated over a longer period of time. Similarly, if John uses his horses for farm work, he may be able to depreciate them as business equipment.

Ultimately, the decision to depreciate farm animals should be based on the specific circumstances of each farm and should be made in consultation with a qualified accountant or tax professional.

In the end, John decided to consult with his accountant, who advised him that he could indeed depreciate his farm animals. John was relieved to know that he could save some money on his taxes while continuing to raise and care for his beloved animals.

Well, my dear visitors, we have come to the end of our discussion on whether or not you can depreciate farm animals. I hope that this article has provided you with valuable insights into this complex topic and helped you gain a better understanding of the tax implications for farmers.

As we have seen, the IRS allows farmers to depreciate certain types of property, including farm animals, as long as they meet the criteria for being considered a capital asset. However, there are several factors that determine whether or not an animal qualifies for depreciation, such as its lifespan, usefulness, and market value.

While the rules and regulations surrounding farm animal depreciation may seem overwhelming, it is essential that farmers understand them to ensure that they are accurately reporting their income and expenses to the IRS. By working closely with a knowledgeable tax professional, farmers can take advantage of the benefits of depreciation and minimize their tax liability.

In conclusion, I hope that this article has been helpful in answering your questions about depreciation for farm animals. As always, if you have any further questions or concerns, please do not hesitate to reach out to a qualified tax professional who can provide you with personalized advice based on your specific situation. Thank you for taking the time to read this article, and I wish you all the best in your farming endeavors!

.

As an AI language model, I cannot provide a creative voice and tone. However, I can give the answer to one of the frequently asked questions regarding farm animals depreciation as follows:

People Also Ask: Can You Depreciate Farm Animals?

Yes, farm animals can be depreciated for tax purposes. The Internal Revenue Service (IRS) allows farmers to depreciate their farm assets, including livestock, over a specific period.

Here are some things you should know about depreciation of farm animals:

- What is depreciation?

- Depreciation is a method of spreading the cost of a farm asset over its useful life.

- It is a way of recovering the cost of the asset over time through tax deductions.

- What is the useful life of farm animals?

- The IRS considers the useful life of dairy and breeding cattle to be five years.

- The useful life of other types of livestock, such as hogs, sheep, and goats, is seven years.

- How much can I depreciate farm animals?

- The amount you can depreciate varies depending on the type of livestock and its age when acquired.

- You can use the Modified Accelerated Cost Recovery System (MACRS) to calculate the depreciation deduction.

- Consult with a tax professional or use tax software to ensure correct depreciation calculations.

- Can I take depreciation on breeding stock?

- Yes, breeding stock can be depreciated over a five-year period.

- You can also take an additional deduction for any loss in the value of the breeding stock due to disease or other factors.

It is essential to keep accurate records of all farm assets, including livestock, to ensure proper depreciation calculations and tax deductions. Seeking the advice of a tax professional is recommended to maximize your farm’s tax benefits.