Table of Contents

Wondering if State Farm Bank offers Insured Cash Sweep? Learn everything you need to know about their high-yield savings account here.

Are you looking for a reliable way to protect your cash deposits? Look no further than State Farm Bank’s Insured Cash Sweep (ICS) program. With this innovative program, you can enjoy peace of mind knowing that your funds are protected by the Federal Deposit Insurance Corporation (FDIC) up to $50 million. But that’s not all – State Farm Bank’s ICS program also offers the convenience of managing your funds through a single account while maximizing your FDIC insurance coverage. So why settle for less when you can have the best? Discover the benefits of State Farm Bank’s ICS program today.

State Farm Bank, a subsidiary of the State Farm Insurance Company, offers a range of financial services to its customers. One of the services that they offer is Insured Cash Sweep (ICS). In this article, we will explore whether State Farm Bank offers ICS and the benefits of using this service.

Insured Cash Sweep (ICS) is a service that allows customers to access FDIC insurance on large deposits while earning interest. This service is available through participating banks and brokerages.

The Benefits of Insured Cash Sweep

There are several benefits to using ICS:

FDIC Insurance

The most significant benefit of ICS is that it provides FDIC insurance on large deposits. The FDIC insures up to $250,000 per depositor, per bank. This means that if a bank fails, the FDIC will reimburse depositors up to $250,000.

Higher Interest Rates

ICS allows customers to earn higher interest rates on their deposits. The service automatically sweeps funds into accounts at different banks, which means that customers can take advantage of the highest interest rates available.

Convenience

Using ICS is convenient because it allows customers to manage their deposits through one account. Customers do not have to open multiple accounts at different banks to take advantage of higher interest rates.

Now that we have discussed the benefits of ICS let us explore if State Farm Bank offers this service. Unfortunately, State Farm Bank does not offer ICS.

If you are interested in using ICS, you can find a participating bank or brokerage that offers this service. The ICS website has a search tool that allows you to find a participating financial institution in your area.

If you are looking for alternatives to ICS, State Farm Bank offers other savings products that may be of interest:

Money Market Accounts

State Farm Bank offers Money Market Accounts that allow customers to earn a competitive interest rate on their deposits. These accounts have no monthly maintenance fees and come with check-writing privileges.

Certificates of Deposit

State Farm Bank also offers Certificates of Deposit (CDs) with competitive interest rates. CDs have fixed interest rates and terms ranging from 12 months to 5 years.

Savings Accounts

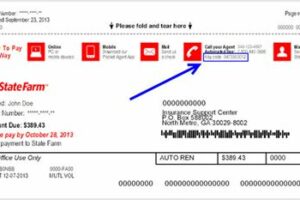

If you are looking for a basic savings account, State Farm Bank offers a Savings Account with a competitive interest rate. This account has no monthly maintenance fees and comes with online banking and mobile app access.

In conclusion, State Farm Bank does not offer Insured Cash Sweep (ICS). However, there are other savings products available that may be of interest to customers looking to earn a competitive interest rate on their deposits. If you are interested in ICS, you can find a participating bank or brokerage through the ICS website’s search tool.

If you’re looking for a way to maximize your FDIC insurance coverage on your deposit accounts, then State Farm Bank’s Cash Sweep Program might be worth considering. With the Insured Cash Sweep (ICS) service provided by State Farm Bank, you can automatically sweep funds above a certain threshold into interest-bearing deposit accounts at multiple banks, providing you with greater FDIC insurance coverage. The program offers both Demand Deposit Account (DDA) and Money Market Deposit Account (MMDA) sweep options, and requires a minimum balance of $5,000 to enroll. While the program can provide depositors with greater FDIC insurance coverage and competitive interest rates higher than traditional savings accounts, it comes with some limitations, such as reducing the liquidity of your funds. Nevertheless, it is an attractive option for depositors looking to earn more interest on their deposits while still having access to their money when they need it. To enroll, simply log in to your State Farm Bank account or contact their customer service department for assistance. With FDIC insurance protection for your deposits up to $250,000 per depositor, per bank, and additional coverage up to $50 million per depositor through the ICS program, you can rest assured that your deposits are safe and secure.

State Farm Bank is a financial institution that provides its customers with various banking products and services. One of the many services offered by State Farm Bank is the Insured Cash Sweep (ICS). The ICS program allows customers to access FDIC insurance on deposits exceeding $250,000 by spreading their funds across multiple banks.

Storytelling

Once upon a time, there was a man named John who had saved up a significant amount of money over the years. He wanted to keep his savings safe and secure but was worried about the FDIC insurance limit of $250,000. John had heard about the Insured Cash Sweep program offered by State Farm Bank and decided to give it a try.

Upon visiting the bank, John was greeted by a friendly customer service representative who explained the benefits of the ICS program. The representative informed John that his funds would be spread across multiple banks, ensuring that his money would be safe and insured up to $50 million.

John was impressed by the program and decided to enroll in the ICS program. He felt relieved knowing that his hard-earned money was safe and secure in the hands of State Farm Bank and the partner banks.

Point of View

As a financial institution, State Farm Bank understands the importance of providing its customers with secure and reliable banking solutions. The Insured Cash Sweep program is one such solution that enables customers to safeguard their deposits while earning a competitive interest rate.

The ICS program also provides customers with the convenience of managing their funds through a single account. By working with partner banks, State Farm Bank ensures that customers receive FDIC insurance on deposits exceeding $250,000, giving them peace of mind.

State Farm Bank takes pride in offering innovative and valuable banking solutions to its customers. The Insured Cash Sweep program is just one example of the bank’s commitment to providing exceptional customer service and ensuring the safety and security of their finances.

Conclusion

State Farm Bank’s Insured Cash Sweep program is an excellent option for customers who want to keep their savings safe and insured while earning a competitive interest rate. The program allows customers to manage their funds conveniently while ensuring that their money is protected up to $50 million.

- If you are interested in the ICS program, visit your local State Farm Bank branch to learn more.

- The customer service representatives will be happy to explain the program in detail and answer any questions you may have.

- By enrolling in the ICS program, you can rest assured knowing that your savings are secure and insured.

Hello there, dear blog visitors! It has been an exciting journey to discuss the topic of State Farm Bank’s Insured Cash Sweep with you. We have explored the ins and outs of ICS and how it can benefit your financial goals. Now, let’s dive into the final thoughts on this topic.

State Farm Bank offers a unique way for customers to earn interest on their cash deposits and still enjoy FDIC insurance protection. With ICS, you can sweep your funds to multiple banks and earn a competitive rate without the hassle of managing multiple accounts. You can also access your funds quickly and conveniently whenever you need them.

Furthermore, State Farm Bank’s ICS program is ideal for individuals and businesses who need to keep cash balances in excess of FDIC insurance limits. ICS allows you to receive full FDIC insurance coverage on deposits up to $50 million. This means that you can have peace of mind knowing that your funds are protected even in the unlikely event of a bank failure.

In conclusion, if you’re looking for a safe and convenient way to earn more on your cash deposits while enjoying FDIC insurance protection, State Farm Bank’s Insured Cash Sweep is an excellent option. With ICS, you can maximize your returns without sacrificing your security. Thank you for joining me on this journey, and I hope you found this information helpful.

.

As a virtual assistant, I am here to help you with your inquiries about State Farm Bank. One of the most frequently asked questions is:

1. Does State Farm Bank Offer Insured Cash Sweep?

Yes, State Farm Bank offers Insured Cash Sweep (ICS) service to its customers. This service allows you to have access to multi-million-dollar FDIC insurance coverage on your deposits.

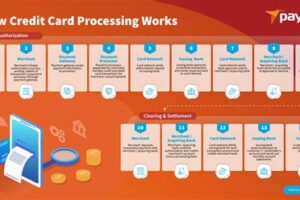

With ICS, your funds are automatically swept into interest-bearing deposit accounts at other banks that are members of the ICS Network. This means that you can enjoy the convenience of having all your funds in one place while still receiving maximum FDIC insurance coverage.

2. How does Insured Cash Sweep work?

When you deposit funds into your State Farm Bank account, they are first deposited into the bank’s general account. Then, based on your instructions, the funds are automatically swept into interest-bearing deposit accounts at other banks in the ICS Network.

The ICS Network consists of hundreds of banks, so your funds are divided into manageable amounts and deposited into accounts at multiple banks, ensuring that each account stays within the FDIC insurance limit.

3. Is there a minimum deposit required for ICS?

Yes, there is a minimum deposit requirement of $100,000 for ICS. If your deposit exceeds this amount, the excess funds will be deposited into your State Farm Bank account.

4. Is there a fee for using ICS?

State Farm Bank does not charge a fee for using ICS. However, the banks in the ICS Network may charge fees for their services. These fees vary by bank and are disclosed in the bank’s Deposit Account Agreement.

Conclusion

State Farm Bank’s Insured Cash Sweep service is a convenient way to maximize the FDIC insurance coverage on your deposits. With ICS, you can enjoy peace of mind knowing that your funds are protected while still earning interest. If you have any further questions about ICS or any other State Farm Bank services, don’t hesitate to contact their customer service team.