Table of Contents

Wondering if State Farm covers hail damage? Find out how to file a claim and what’s covered by your insurance policy with our comprehensive guide.

Are you worried about hail damage to your property? You’re not alone. Hailstorms can cause significant damage to homes, cars, and other personal belongings. As a homeowner or car owner, you may be wondering if your insurance policy covers hail damage. If you have State Farm insurance, you’re in luck. State Farm offers coverage for hail damage, which can provide peace of mind during storm season. However, it’s essential to understand the specifics of your policy and what it covers before a hailstorm strikes.

If you live in an area that is prone to hailstorms, then you probably know the kind of damage they can cause. Hail can be as small as a pea or as big as a softball, and the larger the hail, the more damage it can do. If your car is caught in a hailstorm, the damage can be expensive to repair. This is where insurance comes in. In this article, we will discuss whether insurance covers hail damage, with a focus on State Farm insurance.

What is Hail Damage?

Hail damage refers to any damage caused to property by hailstones. This can include damage to cars, roofs, windows, and other structures. Hail damage can be difficult to detect, especially if the hailstones are small. However, even small hailstones can cause serious damage to a car’s exterior.

Does Insurance Cover Hail Damage?

Whether insurance covers hail damage depends on the type of insurance you have. In general, comprehensive insurance covers hail damage. This means that if you have comprehensive coverage, your insurance will pay for the repairs to your car if it is damaged in a hailstorm.

What is Comprehensive Insurance?

Comprehensive insurance is a type of auto insurance that covers damage to your car that is not caused by a collision. This can include things like theft, vandalism, and hail damage. Comprehensive insurance is not required by law, but it is a good idea to have it if you want to protect your car from unexpected damage.

Does State Farm Cover Hail Damage?

State Farm is one of the largest auto insurance providers in the United States. If you have State Farm insurance, your policy most likely includes comprehensive coverage. This means that if your car is damaged in a hailstorm, State Farm will pay for the repairs.

What Does State Farm Cover?

State Farm covers a wide range of damages, including hail damage. If your car is damaged in a hailstorm, State Farm will pay for the repairs up to the limit of your policy. However, it is important to note that you will still be responsible for paying your deductible.

What is a Deductible?

A deductible is the amount of money you have to pay out of pocket before your insurance kicks in. For example, if you have a $500 deductible and your car is damaged in a hailstorm, you will have to pay $500 before your insurance pays for the rest of the repairs.

How Do I File a Claim for Hail Damage?

If your car is damaged in a hailstorm, you should file a claim with your insurance company as soon as possible. To file a claim with State Farm, you can call their claims department or file a claim online. Be prepared to provide the details of the damage and any other information that your insurance company may ask for.

What Happens After I File a Claim?

After you file a claim, an adjuster from your insurance company will inspect your car to determine the extent of the damage. They will then provide you with an estimate for the cost of repairs. If the cost of repairs is less than the amount of your deductible, you will be responsible for paying the full amount. If the cost of repairs is more than your deductible, your insurance company will pay for the repairs up to the limit of your policy.

Conclusion

In conclusion, if you have comprehensive insurance with State Farm, your policy will most likely cover hail damage. However, you will still be responsible for paying your deductible. If your car is damaged in a hailstorm, file a claim with your insurance company as soon as possible and be prepared to provide the necessary information.

Understanding hail damage is important for any driver, as it can cause significant damage to your car. Hail storms are known to cause dents, cracks, and even shattered windshields, which can be costly to repair. What hail damage may do to your car depends on the size and intensity of the hailstones. Smaller hailstones may only cause minor dents, while larger hailstones can cause serious damage to your vehicle.

So, does State Farm insurance cover hail damage? Yes, if you have comprehensive coverage. Comprehensive coverage is key when it comes to protecting your car from hail damage. It covers damage caused by weather events such as hail, floods, and storms.

However, it’s important to note that making a claim for hail damage may affect your insurance premiums. How hail damage affects your insurance premiums depends on the severity of the damage and the number of claims you’ve made in the past. If you make a claim for hail damage, your insurance company may view you as a higher-risk driver and increase your premiums accordingly.

If you do experience hail damage, repairing it can be a lengthy and expensive process. What to expect when repairing hail damage depends on the extent of the damage. In some cases, the damage can be repaired with paintless dent removal, which is a less expensive and time-consuming option. However, in more severe cases, the entire panel may need to be replaced, which can be costly.

The importance of filing a claim right away cannot be overstated. If you wait too long to file a claim, your insurance company may deny it, leaving you to pay for the repairs out of pocket. Additionally, many insurance companies have strict deadlines for filing claims, so it’s important to act quickly.

Fortunately, there are additional options for protection against hail damage. Some insurance companies offer optional coverage, such as hail damage waivers, which can protect you from having to pay a deductible in the event of hail damage. However, these options may come at an additional cost, so it’s important to weigh the pros and cons before making a decision.

Tips for preventing hail damage to your car include parking in a garage or covered area during hail storms, keeping your car maintained and in good condition, and investing in protective coverings for your car. While these measures may not completely prevent hail damage, they can significantly reduce the risk.

Finally, it’s important to always have comprehensive insurance coverage. Even if you live in an area that doesn’t typically experience hail storms, unexpected weather events can happen at any time. Without comprehensive coverage, you could be left paying for costly repairs out of pocket. So, protect yourself and your car by investing in comprehensive insurance coverage.

As the storm clouds rolled in, Mary knew she was in for a rough night. She had heard that hail was predicted and she wasn’t sure if her insurance would cover the damage. She had State Farm insurance, but she didn’t know much about their policy when it came to hail damage. So, she decided to do some research.

What is Hail Damage?

Hail damage occurs when hailstones strike a surface, causing dents, cracks, and other forms of damage. This can happen to cars, roofs, windows, and other structures. Depending on the severity of the hailstorm, the damage can be extensive and costly to repair.

Does State Farm Cover Hail Damage?

- Yes, State Farm does cover hail damage.

- However, the extent of the coverage depends on the type of policy you have.

- If you have comprehensive coverage, your policy will cover the cost of repairs or replacement due to hail damage.

- If you only have liability coverage, you will not be covered for hail damage.

- It’s important to note that your deductible will apply to any claim you make for hail damage.

What Should You Do if You Have Hail Damage?

- The first step is to assess the damage and document it with photos and videos.

- Contact your insurance company as soon as possible to file a claim.

- They will send an adjuster to assess the damage and provide an estimate for the repairs or replacement.

- If the damage is severe enough, they may recommend that you take your car or property to a qualified repair shop for repairs.

- Be sure to keep all receipts and documentation related to the repairs.

Mary breathed a sigh of relief knowing that State Farm would cover her hail damage. She made a claim and was able to get her car repaired quickly. She was impressed with the efficiency and professionalism of the State Farm team.

So, if you’re wondering if State Farm covers hail damage, the answer is yes – as long as you have comprehensive coverage. Just be sure to document the damage and file a claim as soon as possible.

Well folks, we’ve come to the end of our journey exploring whether or not State Farm covers hail damage. I hope that this article has provided you with a deeper understanding of what is and isn’t covered by your insurance policy. Remember, it’s always important to review your policy thoroughly and speak with your insurance agent if you have any questions or concerns.

It’s clear that State Farm does cover hail damage, but there are some limitations to be aware of. For instance, if your vehicle has pre-existing damage or wear and tear, that may not be covered by your policy. Additionally, in some cases, you may be required to pay a deductible before your coverage kicks in. However, despite these limitations, it’s still comforting to know that your insurance can help protect you in the event of a hailstorm.

As we wrap up, I want to remind you that hail damage can be a serious issue, causing significant damage to your home or vehicle. That’s why it’s so important to have insurance coverage that can help protect you in the event of a storm. If you don’t currently have insurance or are considering switching providers, I encourage you to do your research and find a policy that meets your needs. With the right coverage, you can rest easy knowing that you’re prepared for whatever Mother Nature may throw your way.

Thank you for taking the time to read this article. I hope that you found it informative and helpful. If you have any comments or questions, please feel free to leave them below. And remember, stay safe out there!

.

When it comes to hail damage, many people wonder if their insurance will cover the costs. State Farm is a popular insurance provider, and as such, people often ask if they cover hail damage. Here are some of the common questions and answers regarding hail damage and State Farm insurance:

1. Does State Farm cover hail damage to my car?

Yes, State Farm offers coverage for hail damage to your car. However, the specific coverage will depend on your policy. Some policies may include comprehensive coverage, which typically covers damage caused by hail, while others may not have this coverage. It’s important to review your policy or contact your State Farm agent to determine what kind of coverage you have.

2. Will State Farm cover hail damage to my home?

State Farm also offers coverage for hail damage to your home. Similar to car insurance, the extent of your coverage will depend on your policy. Homeowners with comprehensive coverage are typically protected against hail damage to their property and belongings. However, those with basic policies may not have this coverage.

3. How do I file a hail damage claim with State Farm?

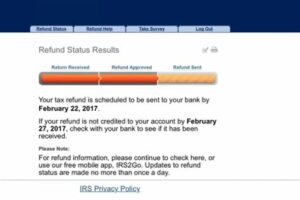

If you experience hail damage to your car or home, you should file a claim with State Farm as soon as possible. To do so, you can call your agent, use the State Farm mobile app, or file a claim online. Be sure to provide as much detail as possible about the damage, including photos, receipts, and any other relevant information.

4. Will filing a hail damage claim affect my premiums?

Filing a hail damage claim with State Farm may affect your premiums in the future. However, this will depend on your specific policy and the amount of damage that was incurred. It’s always best to speak with your State Farm agent to determine how filing a claim will impact your rates.

5. Can I prevent hail damage?

While you can’t control the weather, there are some measures you can take to minimize the risk of hail damage. For cars, parking in a garage or covered area can help protect your vehicle. For homes, installing impact-resistant roofs and windows can reduce the risk of damage. Additionally, keeping trees trimmed and maintaining gutters and downspouts can also help prevent hail damage.

Overall, if you have State Farm insurance and experience hail damage, you may be covered for the costs. It’s important to review your policy or speak with your agent to determine what kind of coverage you have and how to file a claim.