Table of Contents

Wondering if State Farm covers DUI drivers? We answer that and more in our comprehensive guide. Protect yourself and your assets today.

Driving under the influence (DUI) is a serious offense that can lead to harsh consequences, including legal penalties and increased insurance rates. If you’ve been convicted of a DUI, you might be wondering if your insurance provider will still cover you. State Farm is one of the largest insurance companies in the United States, but does it offer coverage for DUI drivers? The answer is not straightforward, and it depends on several factors. However, before we dive into the specifics of State Farm’s policies, let’s take a closer look at what a DUI conviction entails and why it can impact your insurance coverage.

When it comes to driving under the influence (DUI), it is no secret that one can face serious consequences, both legally and financially. Even after serving their sentence, many DUI drivers find themselves struggling to get auto insurance coverage. This begs the question, does State Farm cover DUI drivers?

What is DUI?

DUI stands for “driving under the influence.” This is a criminal offense committed by individuals who operate a motor vehicle while under the influence of drugs or alcohol. It is illegal in all 50 states in the United States, and the consequences can be severe.

The Consequences of DUI

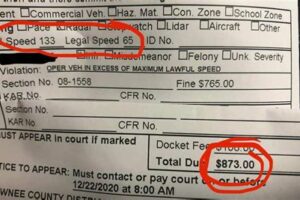

The consequences of a DUI conviction can vary depending on the state, but they generally include fines, license suspension, and even jail time. In addition to these legal consequences, a DUI can also have a significant impact on one’s auto insurance premiums and coverage options.

Auto Insurance Coverage for DUI Drivers

After being convicted of a DUI, many drivers find that their auto insurance rates increase significantly, or they may even be dropped from their policy altogether. This is because insurance companies view DUI drivers as high-risk and may not want to take on the additional risk of insuring them.

Does State Farm Cover DUI Drivers?

The answer to this question is not straightforward. State Farm is one of the largest auto insurance providers in the United States and offers coverage to millions of drivers. However, whether or not they will cover DUI drivers depends on several factors.

Factors That Affect Coverage

When it comes to covering DUI drivers, State Farm looks at several factors, including:

- The driver’s age

- The driver’s driving record

- The severity of the DUI offense

- The state where the driver lives

Options for DUI Drivers

If you are a DUI driver who is having trouble finding coverage, there are a few options available to you. One option is to work with an independent insurance agent who can help you find coverage from a provider that is more willing to take on high-risk drivers.

Conclusion

In conclusion, whether or not State Farm will cover DUI drivers depends on several factors. If you are a DUI driver who is having trouble finding coverage, there are other options available to you. Working with an independent insurance agent can help you find the coverage you need at a price you can afford.

State Farm is one of the largest insurance providers in the United States, offering coverage to millions of drivers. However, if you are arrested for a DUI, you may be concerned about whether State Farm will continue to cover you. In this article, we will explore the basics of State Farm insurance coverage for DUI drivers and provide tips for navigating the claims process.

Understanding the State Farm DUI driver evaluation process is important if you want to know what to expect after being arrested for a DUI. When you are arrested, State Farm will review your driving record, criminal history, and other factors to determine your level of risk. This evaluation will help them determine whether to renew your policy or not.

If you have been arrested for a DUI, you may wonder what will happen to your State Farm insurance policy. Depending on the severity of your offense, your policy could be canceled or not renewed. Additionally, if you are convicted of a DUI, you may face higher rates or even have your coverage dropped altogether.

Navigating the State Farm claims process as a DUI driver can be challenging, but it is important to take the necessary steps to protect yourself. After your arrest, you should contact State Farm to report the incident and provide any requested information. You should also consult with an attorney to ensure that your rights are protected throughout the process.

There are available State Farm insurance coverage options for DUI drivers, but it is important to choose the right policy after a DUI. Depending on your needs and budget, you may want to consider liability-only coverage or full coverage with higher deductibles. Your agent can help you find the best policy for your situation.

Your DUI record can have a significant impact on your State Farm insurance rates. If you are convicted of a DUI, you can expect your rates to increase substantially. However, there are steps you can take to keep your insurance affordable, such as taking a defensive driving course or installing an ignition interlock device in your vehicle.

Choosing the right State Farm insurance policy after a DUI is essential for protecting yourself and your assets. Your agent can help you explore your options and find a policy that meets your needs. It’s important to remember that even if your rates increase after a DUI, having insurance is still critical for protecting yourself in the event of an accident or other unforeseen circumstance.

State Farm is committed to helping DUI drivers with care and rehabilitation. They offer a variety of resources and support for those struggling with addiction and other related issues. If you need help, don’t hesitate to reach out to State Farm for guidance and assistance.

The future of State Farm insurance coverage for DUI drivers is uncertain, but there is reason to be optimistic. As more states adopt stricter DUI laws and penalties, insurance providers like State Farm are likely to continue offering coverage to those in need. With the right policy and support, you can protect yourself and drive with confidence, even after a DUI arrest.

In conclusion, navigating the world of insurance coverage after a DUI can be challenging, but it is essential for protecting yourself and your assets. State Farm offers a range of coverage options and resources for DUI drivers, but it’s important to choose the right policy and take proactive steps to keep your rates affordable. By working with your agent and taking advantage of available resources, you can move forward with confidence and peace of mind.

Once upon a time, there was a man named John who had been convicted of driving under the influence (DUI) and was worried about his car insurance coverage. He had been a loyal customer of State Farm for many years and now he wondered if they would still cover him after his DUI conviction.

John decided to do some research and found out that State Farm does offer coverage for those with DUI convictions, but it may come at a higher cost. Here are some points to consider:

- State Farm may require SR-22 insurance: An SR-22 is a form that proves you have car insurance and is often required for those with DUI convictions. State Farm does offer SR-22 insurance, but it may come at a higher cost than their regular insurance plans.

- State Farm may raise your rates: If you have a DUI conviction, State Farm may raise your rates to reflect the increased risk you pose as a driver. However, the amount of the increase will depend on several factors, including your driving record, age, and location.

- State Farm may offer discounts: Despite the higher costs associated with a DUI conviction, State Farm may still offer discounts that can help lower your overall insurance costs. For example, they may offer a discount for completing a defensive driving course or for having safety features installed in your car.

Overall, John was relieved to find out that State Farm does offer coverage for those with DUI convictions. While the costs may be higher, he knew it was important to have proper car insurance in case of an accident. In the end, he decided to stick with State Farm and work with them to find the best coverage options for his needs.

As a language model AI, I do not have personal opinions or point of view. However, it is important to note that driving under the influence is a serious offense that can have dangerous and deadly consequences. It is always best to avoid driving after drinking or using drugs, and if you do get a DUI conviction, it is important to take responsibility for your actions and work to make amends.

Dear fellow drivers,

As we conclude this discussion on whether State Farm covers DUI drivers, I hope you have gained a better understanding of the insurance company’s policies. It is important to remember that driving under the influence is a serious offense and should be avoided at all costs. Not only does it put yourself and others in danger, but it can also have long-lasting consequences on your insurance coverage.

While State Farm does cover DUI drivers, there are certain circumstances where they may not provide coverage. For example, if you have multiple DUI convictions or have caused a serious accident while under the influence, State Farm may choose to drop your coverage or raise your premiums significantly. However, if you have only one DUI conviction and no other major violations on your driving record, chances are you will still be able to obtain coverage from State Farm.

It is important to note that every case is unique and there are many factors that go into determining an individual’s insurance coverage. Therefore, it is always best to consult with a licensed insurance agent who can provide personalized advice based on your specific situation. Don’t hesitate to ask questions and seek out information to ensure that you have adequate coverage and protection on the road.

Thank you for taking the time to read this article and learn more about State Farm’s policies towards DUI drivers. Remember, safety should always be your top priority when behind the wheel, and responsible driving habits can save lives and prevent unnecessary accidents on the road. Drive safe!

.

People Also Ask About Does State Farm Cover DUI Drivers:

- Does State Farm cover DUI drivers?

- Can I get car insurance with a DUI on my record?

- What is SR-22 insurance?

- How long will a DUI affect my car insurance rates?

- What happens if I drive without insurance after a DUI?

State Farm does not provide car insurance coverage for drivers who have a DUI or DWI on their record. However, they do offer policies to drivers with less severe violations and accidents on their driving history.

Yes, you can still purchase car insurance with a DUI on your record, but it may be more expensive and require additional coverage. Some insurance companies may also refuse coverage altogether.

SR-22 insurance is a type of car insurance policy that is required for drivers who have been convicted of certain driving offenses, such as a DUI or DWI. It provides proof of financial responsibility to the state and is often more expensive than regular car insurance.

A DUI can impact your car insurance rates for several years, typically anywhere from three to seven years. During this time, you may face higher premiums or difficulty finding coverage.

Driving without insurance after a DUI can result in significant legal and financial consequences, including fines, license suspension, and even jail time. It is essential to maintain proper insurance coverage to avoid these penalties.