Table of Contents

Wondering if State Farm covers E & O insurance? Learn about the options available and how to get coverage for your business needs.

Are you a business owner looking for insurance coverage for errors and omissions? State Farm might be your solution. With State Farm’s E & O insurance, you can protect your business from financial losses caused by mistakes or negligence in your professional services. But wait, what exactly is E & O insurance, and why do you need it? Let’s dive deeper into the topic to understand the importance of this type of coverage and how State Farm can help.

As a business owner, it’s essential to have the proper insurance coverage to protect your company from potential liabilities. One of the most crucial policies for any business is errors and omissions (E&O) insurance. This policy protects companies from lawsuits related to professional mistakes or negligence. While many insurance providers offer E&O insurance, business owners often wonder if State Farm covers this type of policy.

Does State Farm Offer E&O Insurance?

State Farm is a well-known insurance provider that offers a wide range of policies for individuals and businesses. However, when it comes to E&O insurance, State Farm does not offer this type of policy. Instead, they focus on other types of commercial insurance coverage, such as general liability, property, and workers’ compensation insurance.

Why Doesn’t State Farm Offer E&O Insurance?

Every insurance company has its own set of policies and focus areas. State Farm has chosen not to offer E&O insurance because they believe that other types of insurance are more important for their clients’ needs. They focus on providing comprehensive coverage for small businesses and individuals rather than specializing in one specific area of insurance.

Where Can You Get E&O Insurance?

Just because State Farm doesn’t offer E&O insurance doesn’t mean that you can’t get coverage. There are many other insurance providers that specialize in this type of policy, and you can find one that meets your needs. Some companies that offer E&O insurance include:

- Chubb

- Hiscox

- CNA

- Travelers

- Liberty Mutual

Each of these companies has its own set of policies and pricing, so it’s essential to shop around and compare quotes before choosing a provider.

Who Needs E&O Insurance?

E&O insurance is critical for businesses that provide professional services or advice. This includes lawyers, accountants, architects, consultants, and other professionals who offer expertise to their clients. If a client accuses a business of making an error or omission that results in financial losses, E&O insurance can protect the company from costly lawsuits and legal fees.

What Does E&O Insurance Cover?

E&O insurance covers a wide range of potential liabilities, including:

- Professional negligence or errors

- Breach of contract

- Misrepresentation

- Violation of good faith and fair dealing

- Intellectual property infringement

Depending on the policy, E&O insurance may also cover defense costs, settlements, and damages awarded in a lawsuit.

How Much Does E&O Insurance Cost?

The cost of E&O insurance varies depending on several factors, including:

- The type of business

- The size of the business

- The level of risk involved in the business

- The coverage limits and deductibles chosen

On average, E&O insurance can cost anywhere from $500 to $5,000 per year. However, the cost may be higher or lower depending on your specific business needs.

Final Thoughts

While State Farm does not offer E&O insurance, there are many other insurance providers that do. If you’re a professional service provider or consultant, E&O insurance is essential to protect your business from potential liabilities. Shop around and compare quotes from different providers to find a policy that meets your needs and budget.

As a professional, you strive to provide the best possible service to your clients. However, mistakes can happen, and errors and omissions (E&O) insurance can provide protection in case of legal claims arising from your professional services. State Farm is a well-known provider of insurance products, but does it cover E&O insurance? Let’s explore the basics of E&O insurance, why it’s important for certain professions, State Farm’s coverage options for E&O insurance, how to determine if you need it, common scenarios where it’s necessary, what’s not covered, how to file a claim with State Farm, factors that affect cost, comparing State Farm to other providers, and the benefits of obtaining E&O insurance from State Farm.

E&O insurance is a type of liability insurance that protects professionals and businesses from legal claims related to their services. It’s often referred to as professional liability insurance or malpractice insurance, depending on the industry. The coverage typically includes defense costs and damages awarded to the claimant. It’s important to note that E&O insurance doesn’t cover intentional wrongdoing or criminal acts.

Professionals who provide advice, expertise, or services to clients may benefit from E&O insurance. This includes but isn’t limited to doctors, lawyers, insurance agents, real estate agents, financial advisors, and consultants. Clients may sue these professionals for negligence, breach of contract, misrepresentation, or other errors or omissions in their services. Even if the claim is unfounded, defending against it can be expensive and time-consuming.

State Farm offers E&O insurance for certain professions, such as insurance agents and real estate agents. The coverage options vary by state and profession, and they may include limits for defense costs and damages, deductibles, and exclusions. For example, State Farm’s real estate E&O insurance may cover claims related to errors in property listings, failure to disclose property defects, or misrepresentation of property information. However, it may not cover claims related to environmental hazards, fraud, or intentional wrongdoing.

If you’re unsure whether you need E&O insurance, consider the nature of your services, the frequency and severity of claims in your industry, and the potential financial impact of a claim on your business. Some professions may require E&O insurance by law or regulation. For example, insurance agents in some states must have E&O insurance to maintain their license. Others may need it to meet client requirements or contractual obligations.

Common scenarios where E&O insurance is necessary include but aren’t limited to: a doctor misdiagnosing a patient, a lawyer giving incorrect legal advice, a financial advisor making poor investment decisions, a real estate agent failing to disclose property defects, and a consultant providing inadequate recommendations. In each case, the client may suffer harm and seek compensation from the professional. E&O insurance can help mitigate the financial and reputational damage of such claims.

It’s important to note that E&O insurance doesn’t cover all types of claims or losses. For example, it typically doesn’t cover bodily injury or property damage caused by the professional’s services. It also doesn’t cover intentional acts, criminal acts, or punitive damages. Additionally, some policies may have specific exclusions or limitations, such as cyber liability or employment practices liability. It’s essential to read the policy carefully and understand what’s covered and what’s not before purchasing it.

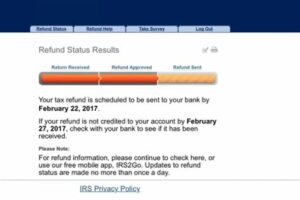

If you need to file a claim for E&O insurance with State Farm, you should contact your agent or the claims department as soon as possible. You’ll need to provide details of the claim, including the date, the nature of the alleged error or omission, and any supporting documentation or witness statements. State Farm will investigate the claim and may provide legal representation if necessary. If the claim is covered, State Farm will pay damages up to the policy limits, less any deductible.

The cost of E&O insurance from State Farm or any other provider depends on several factors, such as the profession, the coverage limits, the deductible, the claims history, and the location. Generally, professions with higher risk or frequency of claims will have higher premiums. For example, a surgeon may pay more for malpractice insurance than a librarian. It’s important to shop around and compare quotes from multiple providers to find the best value for your needs.

Comparing State Farm to other providers of E&O insurance can help you make an informed decision. You should consider the coverage options, the reputation and financial stability of the insurer, the customer service and claims handling, and the cost. State Farm is a reputable and financially stable insurer with a strong presence in many states. However, it may not offer the most competitive rates or the broadest coverage options for all professions.

The benefits of obtaining E&O insurance from State Farm include the peace of mind that comes with having a trusted insurer on your side, the ability to customize your coverage to your needs, and the convenience of bundling it with other insurance products. State Farm also offers discounts for certain professional associations and good claims history. However, it’s essential to read the policy carefully and understand what’s covered and what’s not, and to compare rates and coverage options from other providers to ensure you’re getting the best value.

In conclusion, E&O insurance is an important protection for professionals who provide services to clients. State Farm offers E&O insurance for certain professions, but the coverage options and cost vary by state and industry. If you’re considering purchasing E&O insurance, it’s important to understand the basics, determine if you need it, and compare options from multiple providers. E&O insurance can provide peace of mind and financial protection in case of legal claims arising from your professional services.

Once upon a time, there was a small business owner named Jane who ran a marketing agency. She had heard about E & O insurance and wondered if her current insurance provider, State Farm, covered it.

Jane decided to do some research and found that E & O insurance, also known as errors and omissions insurance, protects businesses from lawsuits related to professional mistakes or negligence. As a marketing agency, Jane knew that mistakes in advertising campaigns or incorrect advice given to clients could potentially lead to legal action.

After searching the State Farm website and speaking with a representative, Jane discovered that State Farm does offer E & O insurance for certain professions, but unfortunately, marketing agencies were not on the list. Disappointed, Jane wondered what her options were.

Here are a few things to know about E & O insurance and State Farm:

- State Farm offers E & O insurance for several professions, including real estate agents, architects, engineers, and accountants.

- If your profession is not listed, it’s possible that State Farm may not offer E & O insurance for your specific needs.

- It’s important to shop around and compare quotes from different insurance providers to find the best coverage for your business.

Jane realized that she would need to look for a different insurance provider that offered E & O insurance for marketing agencies. She researched several options and ultimately found a policy that met her needs.

The moral of the story? It’s important to understand what types of insurance your business needs, and to shop around to find the best coverage. While State Farm may not cover E & O insurance for all professions, there are other providers out there who may be able to help.

Greetings, dear visitors! We hope you have found our article on State Farm’s coverage of E & O insurance informative and useful. As we wrap up, we’d like to leave you with a few final thoughts on the subject.

First and foremost, it’s important to note that while State Farm does offer a variety of insurance products, including E & O coverage, the specifics of each policy can vary based on location and individual circumstances. That’s why it’s crucial to consult with a licensed insurance agent to determine the best options for your business or professional needs.

Additionally, we encourage you to carefully consider the risks and liabilities associated with your line of work, and to take proactive steps to protect yourself and your assets. E & O insurance can provide valuable peace of mind and financial protection in the event of a lawsuit or other legal dispute, but it’s just one aspect of a comprehensive risk management strategy.

In conclusion, we hope this article has shed some light on the topic of E & O insurance and its availability through State Farm. As always, we welcome your questions and feedback, and we wish you all the best in your endeavors!

.

People often ask if State Farm covers E & O insurance. Here are some of the common questions:

- What is E & O insurance?

- Does State Farm offer E & O insurance?

- What types of professionals need E & O insurance?

- How much does E & O insurance cost?

- Is E & O insurance required by law?

E & O insurance stands for Errors and Omissions insurance. It provides coverage for professionals who make mistakes or fail to perform a service as promised. This type of insurance can protect professionals from financial damages that may arise from lawsuits filed by clients or customers.

No, State Farm does not offer E & O insurance. They specialize in property and casualty insurance, life insurance, and annuities. However, they do offer liability insurance for businesses, which can provide some protection against lawsuits related to errors and omissions.

Professionals who provide advice, consultation, or services to clients may need E & O insurance. This includes lawyers, accountants, real estate agents, financial advisors, and other professionals who work with clients on a regular basis. Without E & O insurance, these professionals may be vulnerable to costly lawsuits if they make a mistake or fail to fulfill a service agreement.

The cost of E & O insurance varies depending on the profession, the level of risk involved, and the amount of coverage needed. Some professionals may be able to purchase a policy for a few hundred dollars per year, while others may need to pay several thousand dollars per year for comprehensive coverage.

For most professions, E & O insurance is not required by law. However, some industries may have specific regulations or requirements that mandate certain levels of coverage. Additionally, many clients or customers may require professionals to carry E & O insurance as a condition of doing business.

While State Farm does not offer E & O insurance, there are many other insurance providers that specialize in this type of coverage. If you are a professional who provides services or advice to clients, it may be worth considering E & O insurance to protect yourself from potential lawsuits and financial damages.