April 24, 2024

0 comment

Hobbs Farm Equipment Inc. is a leading provider of high-quality agricultural machinery and equipment. With a wide...

Boost Your Farm’s Efficiency with Hobbs Farm Equipment

April 23, 2024

0 comment

Latest Posts

April 26, 2024

0 comment

Get comprehensive insurance coverage and financial services with Will Hardin State Farm. Protect your assets and secure...

Unveiling Animal Farm’s True Leader: Identifying the Characters Who Assume Leadership Roles

February 10, 2024

0 comment

The characters in Animal Farm who display leadership qualities are Napoleon and Snowball, as they both strive...

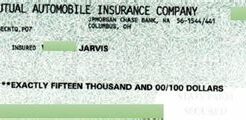

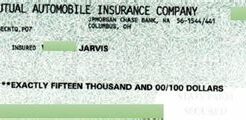

Clearing State Farm Checks: A Comprehensive Guide to the Time it Takes for Check Deposits to Process

April 26, 2024

0 comment

Waiting for your State Farm check to clear? Find out how long it takes and get peace...

Clearing State Farm Checks: A Comprehensive Guide to the Time it Takes for Check Deposits to Process

April 26, 2024

0 comment

Waiting for your State Farm check to clear? Find out how long it takes and get peace...